Gold is trading near record highs, while price pullbacks are attracting new buyers. Two key drivers behind the gold rally are a change in the Fed’s outlook and geopolitics. Jerome Powell emphasises that, given the bilateral risks, the central bank cannot take a risk-free path. Choosing between supporting full employment and inflation control, the Fed now turns its attention to the former.

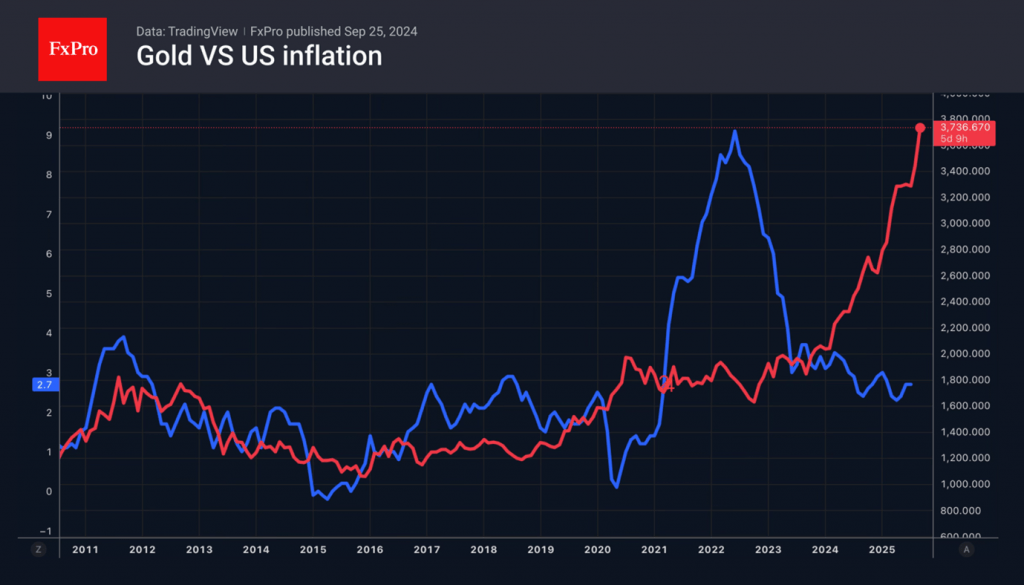

Gold is considered a hedge against inflation. However, the Fed is the main defender against price acceleration and rising rates. In such conditions, gold often falls. However, when the central bank washes its hands of the matter, gold spreads its wings. This was the case in 1979, when it jumped 140% due to lower rates against a background of high inflation. About the same thing is happening now.

Donald Trump has abandoned the idea of quickly ending the armed conflict in Ukraine. This is leading to a bipolar world, intensifying the processes of de-dollarisation and diversification of gold and foreign exchange reserves, which is adding fuel to the fire of the gold rally.

The FxPro Analyst Team