- The US economy is strong, thanks to spending on AI.

- The Fed is easing interest rates while tightening forecasts, but the Trump factor has not yet played out.

A strong economy equals a strong currency. The US dollar remains stable even as the probability of a Fed rate cut in December rises to 81%. A leading indicator from the Federal Reserve Bank of Atlanta signals an acceleration in gross domestic product from 3.8% in the second quarter to 4.2% in the third quarter. The BLS is set to release GDP data for July-September before Christmas. This is likely to be a gift to both the White House and all Americans.

Artificial intelligence is behind the strength of the US economy. According to Deutsche Bank, private investment, excluding AI, is comparable to 2019. If data centres are excluded, commercial construction has virtually stalled. Bank of America estimates that the capital expenditure of four companies, Microsoft, Amazon, Alphabet and Meta Platforms will increase from $228 billion to $344 billion in 2025. This is equivalent to 1.1% of GDP.

At the same time, rising tech stocks are increasing the wealth of Americans, driving consumer spending and accelerating the economy. Can the United States stand up to Europe? Judging by the disappointing statistics on the business climate in Germany, investors are sceptical about the speed of Friedrich Merz’s fiscal stimulus measures.

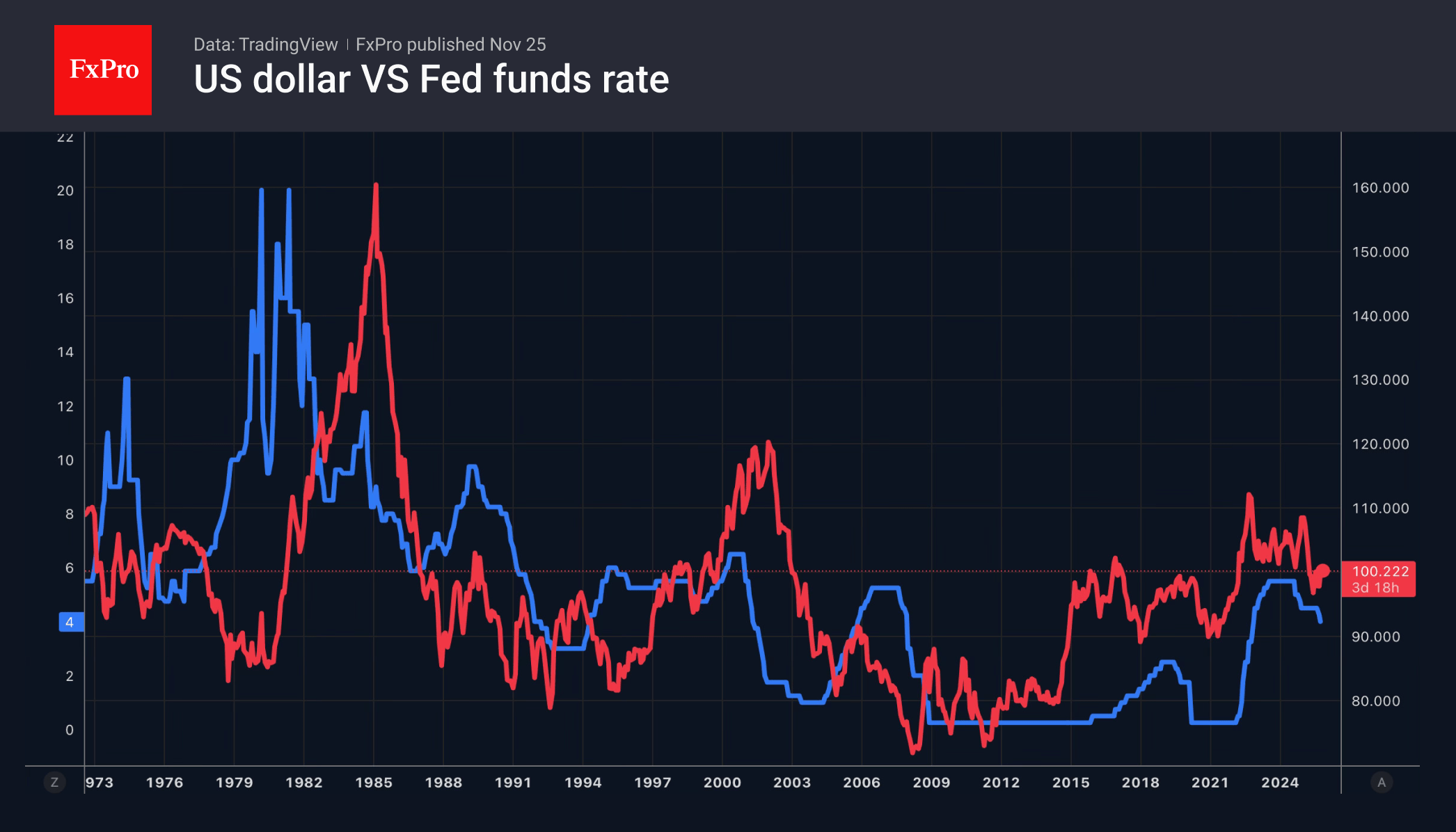

As for the recovery of expectations for a rate cut in December, the stability of the US dollar is understandable. In September and October, the dollar index rose after the rate cut in September, as the FOMC reduced the number of expected cuts in its updated forecasts.

History risks repeating itself for the third time in December. Jerome Powell will find a delicate compromise between the Fed’s hawks and doves, cutting rates but sending an even stronger signal of at least a pause in the near term. The dollar’s dynamics are influenced by expectations for the key rate over the next two years, and investors often look beyond a single meeting.

If everything depended solely on the Fed, it would be easier for investors. However, there is the Trump factor in the markets. The US president will not abandon his attempts to weaken the US dollar. There is also the economy, a factor that is only beginning to reveal itself.

The FxPro Analyst Team