The US central bank kept its monetary policy unchanged at the end of the two-day meeting. This was in line with market expectations and therefore did not cause much excitement. Nevertheless, the outcome of the discussion was neither dull nor “passé”.

In an official commentary, the Fed made it clear that it is ready to proceed with a soft rollback of monetary stimulus before the end of the year. Markets were pricing in a slim chance that tapering would be announced in September. However, the publication of these comments triggered some relief rally for equities, with leading US indices closing around 1% up on Wednesday.

The Fed’s pronounced stance puts risky asset purchases back in the focus of investors and allows for equity indices to return to their recent all-time highs in the next few weeks.

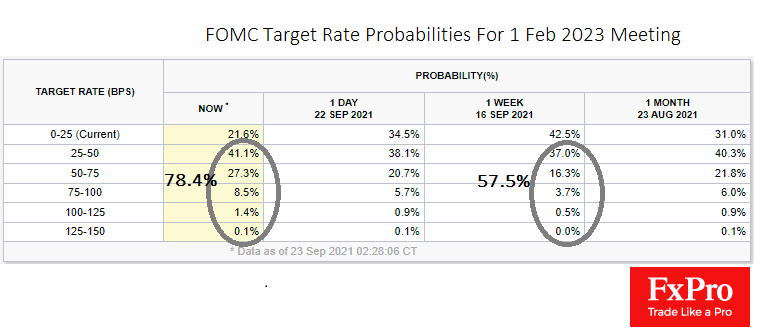

However, on the currency and debt market, the chances of further strengthening the US dollar increase. More than half of the FOMC members predict a rate hike by the end of 2022, just a few months after the end of QE. Remarkably, after the GFC, there was one year between the end of the QE and a rate hike date.

The debt and currency markets will no longer build on this and will likely be more actively pricing in an accelerated normalisation of US policy.

Considering past practice in terms of the events themselves rather than their duration, it is worth setting ourselves up for a stronger dollar over the next two to three quarters with the potential for DXY gains of 7.5-12% from current levels. This would return the US currency to the highs of recent years.

The outlook for dollar growth outside of this horizon is highly uncertain. Other central banks are likely to catch up with the Fed very quickly and could even act more aggressively in tightening monetary policy, as EM countries S. Korea and Norway are already doing.

The FxPro Analyst Team