Cautious optimism prevails in the markets at the beginning of the week, if we exclude a couple of worrying signs for investors. A wave of purchases continues in the stock markets. Risk-sensitive GBP and AUD on Tuesday morning added about 0.3% in pairs with the dollar, although they are some distance away from the highs of late July. Gold slipped below $2000, and the major Asian indices are confidently adding more than 1% due to optimism around support packages and in anticipation of China-US trade talks.

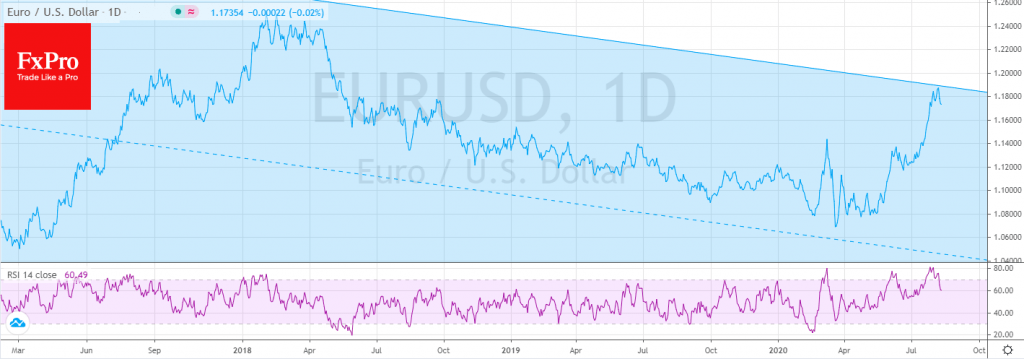

Despite overall optimism, EURUSD records lower intraday lows for the fourth consecutive trading session and traded at 1.1750 on Tuesday morning. This occurred after several unsuccessful attempts to gain a foothold above 1.1900 in the last two weeks, forming a double top. A further drop below 1.1700, the lows of local correction in July and August, can open the path to a more substantial pressure, potentially sending EURUSD to 1.1650. In case of a more profound correction, we can’t exclude a deep fall below 1.1500,

Investors move from euros to dollars after reports of record volumes of sell positions on the dollar index and buy positions on the euro. This is a sign that could deprive the single currency’s fuel for further increase. However, it may also be a precursor for a broader recovery of the USD, if the downward movement of EURUSD goes boldly below 1.1700.

Elsewhere, there are interesting dynamics to the major US stock indices recently, where there are further signs of rotation in leaders. Dow Jones added more than 1.3% on Monday and S&P500 rose by only 0.3%, while Nasdaq Composite dropped by 0.4%. This situation is noteworthy because, in previous months, companies from the Nasdaq were pulling the markets up. Now the interest of the participants is shifting from “growth” to “value” stocks, which can generate regular profits.

Futures on Dow Jones have already added 6% so far this month, reaching 28000. This is twice the growth of the S&P500 and three times stronger than that of Nasdaq for this period. However, one should be cautious about the increasing pressure on the “growth” stocks.

The market take-off in previous months resembled the dynamics of the days of dotcoms. However, the bubble blowout that followed knocked about 80% from Nasdaq, almost twice as much as the losses on the S&P500 and Dow Jones.

As positive sentiment prevails, it is barely worth speculating on a long term decline of the Nasdaq, or a general collapse of the markets.

The FxPro Analyst Team