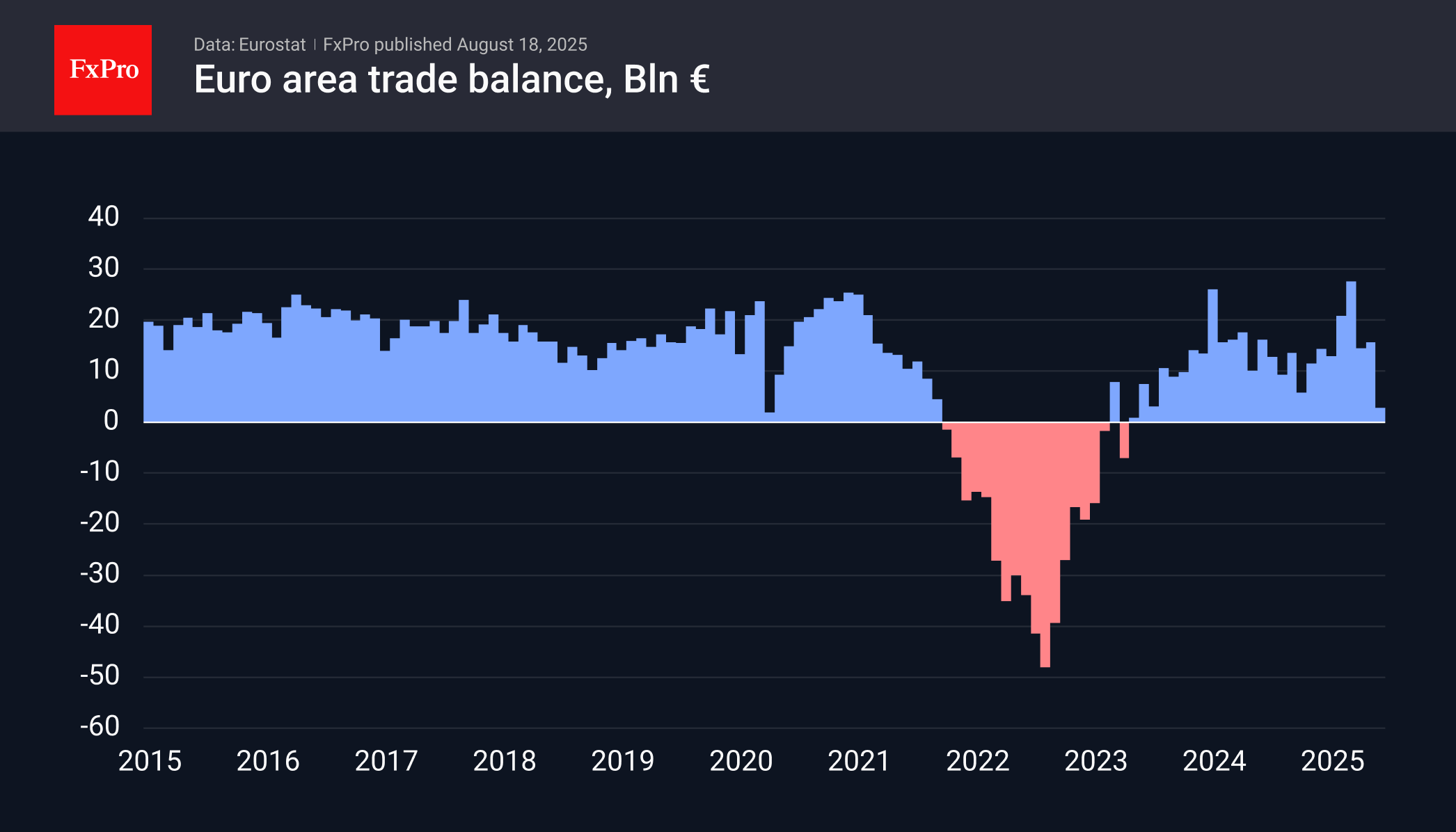

Tariffs led to volatility in foreign trade indicators sparing Europe. The eurozone’s trade surplus fell to €7 billion in June. Adjusted for seasonal factors, the surplus is even lower at €2.8 billion, the lowest since May 2023, when Europe suffered from soaring energy prices and the rejection of Russian supplies, which made logistics more expensive.

In January-March, monthly exports added more than 10% to the average levels of the previous two years, fuelling a temporary surge in the surplus. Now it has returned to the norm of recent years. However, imports have grown despite the decline in energy prices.

This is fundamentally bearish news for the euro, as it reflects a sharp decline in capital inflows to the region. In addition, the decline in exports may prompt the ECB to continue easing policy after its recent pause.

The statistics did not cause significant volatility in the euro, as traders are focused on signals about European negotiations in Washington. Nevertheless, today’s statistics are an important piece of the puzzle for shaping euro trends.

The FxPro Analyst Team