- The ECB is weighing the strengths of the euro, and the US jobs report will determine the path of EURUSD.

- Switzerland and Canada are satisfied with the current interest rates.

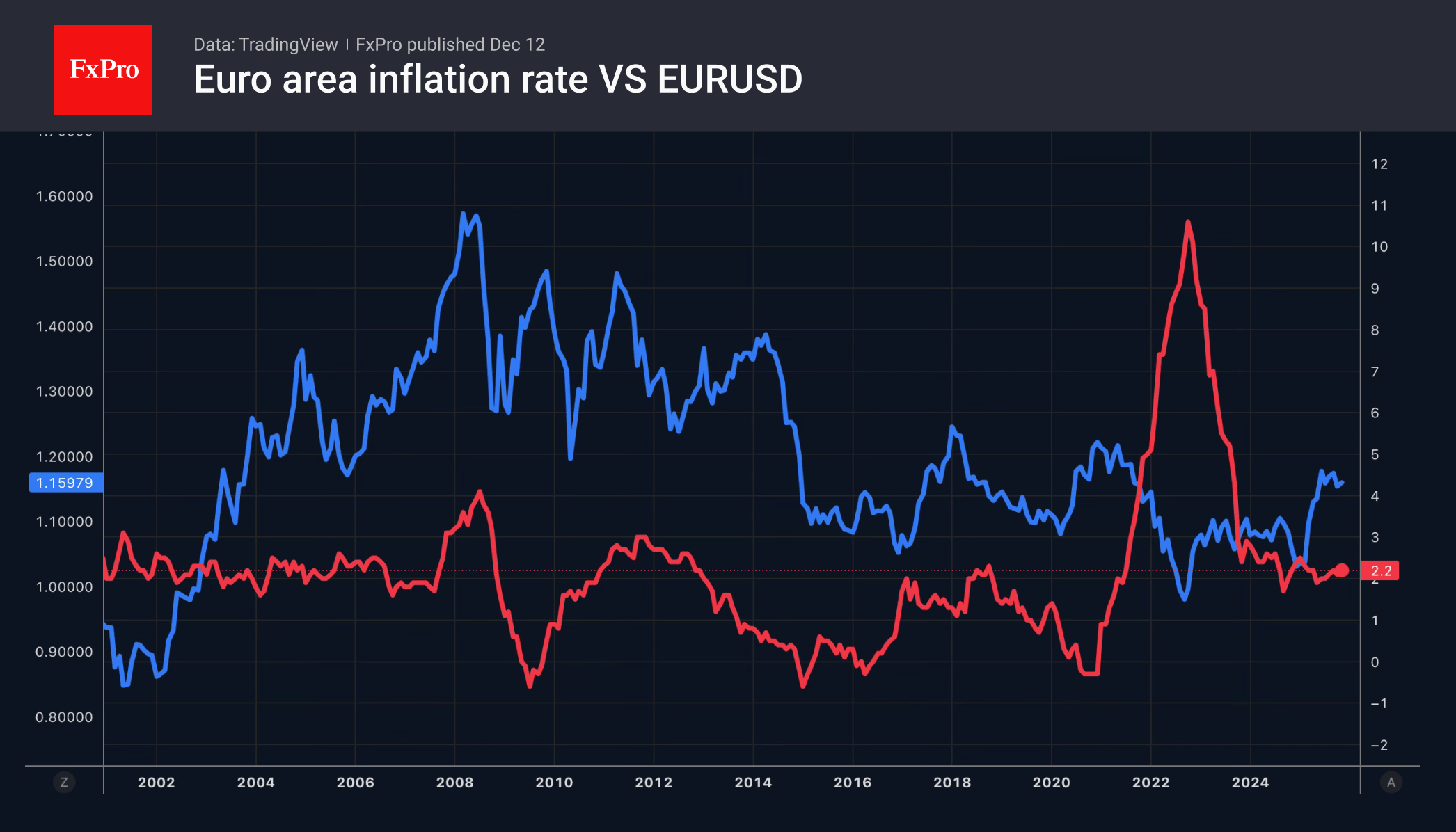

The weakening of the US dollar after the Fed’s hawkish cut has not left other central banks indifferent. They usually follow the Fed as the leader of the pack, as its decisions affect the greenback and inflation rates around the world. The ECB forecasts that consumer prices will slow to 1.7% in 2026 and return to the 2% target in 2027. However, the EURUSD rally of more than 13% since the start of 2025 poses a threat to this plan.

According to estimates announced by Chief Economist Philip Lane, a 10% strengthening of the euro is expected to slow the CPI over the next three years. The most significant impact, at -0.6 percentage points, will be felt in the first year. Inflation in the eurozone risks deviating significantly from the target due to divergences in monetary policy, and the ECB needs to take action.

Unsurprisingly, several members of the Governing Council have returned to dovish rhetoric. François Villeroy de Galhau, the head of the Bank of France, stated that he cannot rule out further rate cuts. This contradicts Isabel Schnabel’s opinion. The German is satisfied with the forecasts of the futures market that the ECB’s next step will be to tighten rather than ease monetary policy.

The European Central Bank has timing on its side, as key US employment statistics for October and November will be published before its meeting on December 18. An improvement in the US labour market will allow the ECB to avoid returning to dovish rhetoric. It will be a different matter if the market continues to deteriorate.

Meanwhile, other central banks are extending their pause in their policy easing cycle. The Bank of Canada kept its overnight rate at 2.25% and noted that it is in the right place. The futures market is pricing in the possibility of tightening by the end of 2026, which has allowed USDCAD bears to push prices down to their lowest levels since mid-September.

The Swiss National Bank left borrowing costs at zero and lowered its CPI forecasts. The SNB noted that the weakening inflation outlook does not justify a return to negative interest rates. USDCHF quotes plummeted to 0.7950, the lowest level since July.

The FxPro Analyst Team