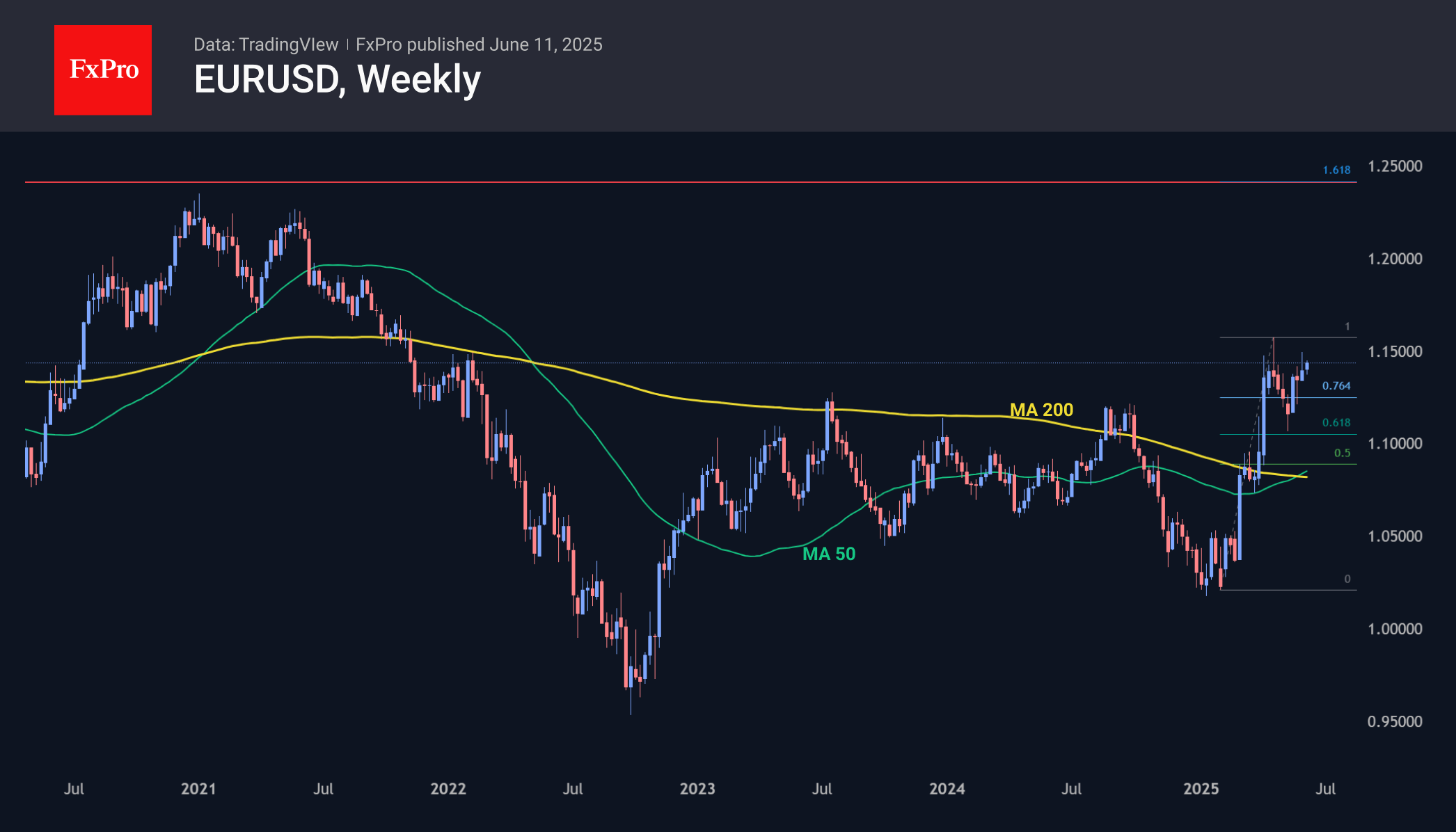

The single currency has been showing a trend of increasingly higher local declines throughout the month. Growth impulses in April and earlier in June hit an invisible soft ceiling approaching 1.15, but this appears to be only a temporary shake-up of positions after an impressive rise and before further growth.

The euro is supported by politicians who are one after another abandoning budgetary constraints in favour of stimulus measures. The stimulus measures are concentrated in the military sector, but this is largely irrelevant to the currency market. The recent decline in energy prices, an important item of industry expenditure, is also positive for the euro.

We also note the sustained support that EURCHF and USDCHF have experienced over the past couple of months, suggesting that the Swiss National Bank is working to curb the franc’s growth, a familiar task for this central bank.

As a result of all these forces, the euro is trading close to 166 against the Japanese yen, near its October highs, adding 7.5% to its February lows. EURUSD is completing a corrective pullback from 1.1570 to 1.1060, which took place in April-May. Technically, breaking through the latest highs will make the next target the 1.24-1.25 area, surpassing the 2020 peaks.

This year’s EURUSD growth has broken the long-term downward trend. However, confirmation will be needed with growth above the previous cyclical high in the 1.25 area before it is justified to talk about a new long-term growth cycle for the euro, like that seen in 2002. Fundamentally, this will require a return to soft monetary policy with a tolerant view of inflation slightly above 2% and a reduction in rates at the first signs of an economic slowdown. This is not Powell’s current approach, but who knows what fate awaits us around the corner?

The FxPro Analyst Team