- Inflation and the US labour market are slowing down, while the chances of a rate cut are increasing.

- The US dollar is vulnerable, while the euro is being helped by business activity.

The US dollar had its worst series of daily declines since 2020, mainly due to the increased likelihood of an interest rate cut by the Fed and the improved positions of its main competitors. The pound is rising as fears about the budget have been allayed. The yen and the Australian dollar are awaiting interest rate hikes by their respective central banks. The euro is rising due to improved trade conditions, falling energy prices and hopes for peace in Eastern Europe. The USD index is further weakened by demand for hedging in anticipation of the Christmas rally in US stock indices.

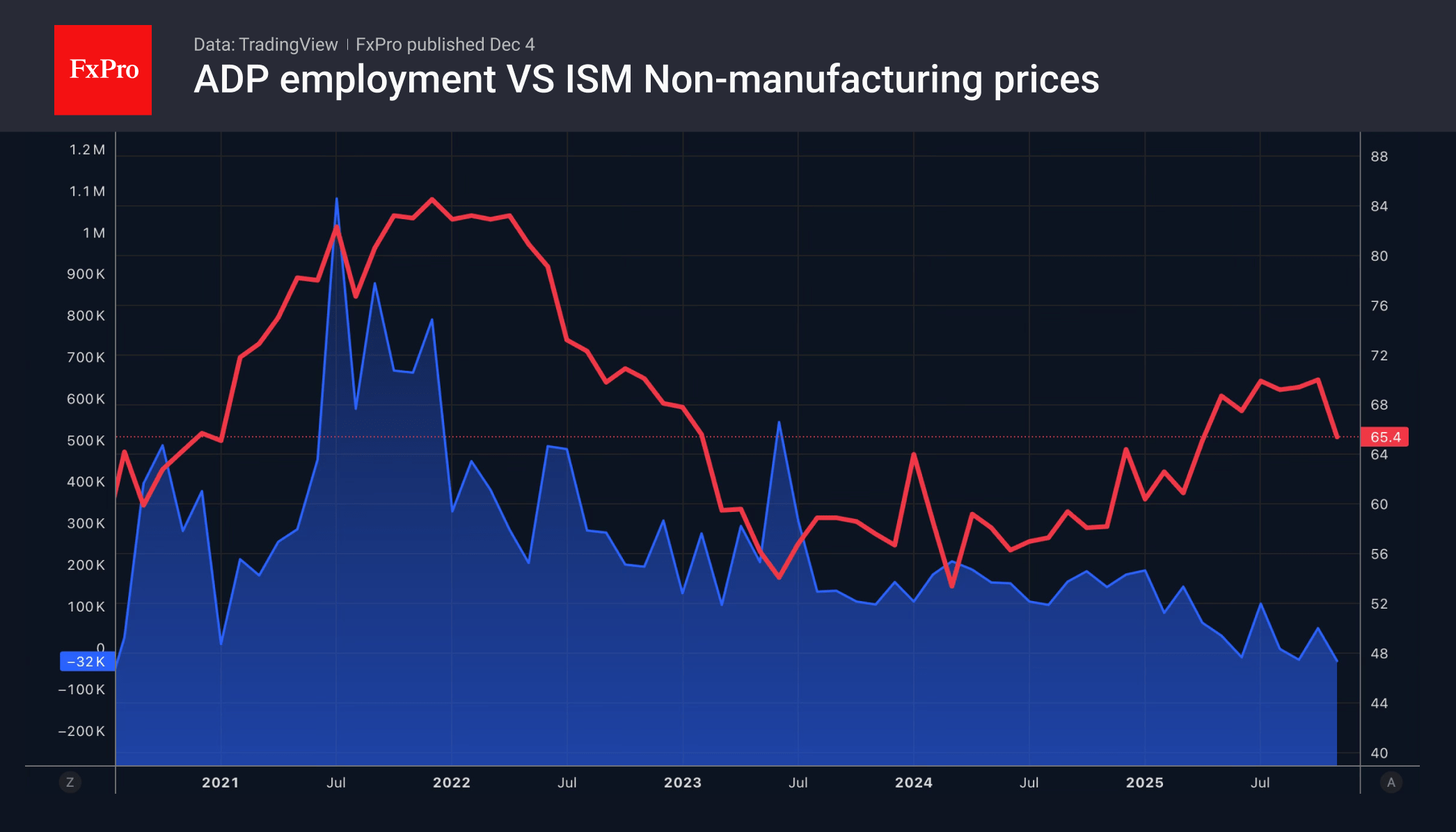

A decline in private sector employment by 32K in November, according to ADP, and a fall in the price component of the PMI in the services sector to a 7-month low have strengthened the position of speculators betting on a decline in December. Doves at the Fed believe it is better to play it safe and ease policy to prevent an uncontrolled surge in unemployment. Hawks complain that lowering rates will accelerate inflation, which is already gaining momentum.

The arguments of the first group of FOMC officials seem more convincing, which is why the futures market assigns a 89% probability of a 25-point cut on December 10th and approximately a 50% chance of a 100-point cut within a year. Since no further reductions are expected from the ECB in the coming year, the market is re-evaluating in favour of EURUSD growth.

Moreover, even without divergence in monetary policy, the US dollar has many vulnerabilities. The potential repeal of tariffs by the Supreme Court, the twin deficits in the budget and trade balance, and faster economic growth outside the US are all factors in favour of a further decline in the USD index.

The euro, on the contrary, draws strength from the remarkable stability of the eurozone. In November, the composite business activity index rose to its highest level in 2.5 years, adding to its sixth consecutive month of growth. Its positive dynamics give hope for a reduction in the economic growth divergence with the US. Along with the divergence in monetary policy between the ECB and the Fed, the economy is driving the upward trend in EURUSD.

The FxPro Analyst Team