The US dollar is putting pressure on other currencies. Earlier, we noted how the CAD, NZD and JPY were ready to give up, having been at their lowest levels in recent months. However, the USD brazenly ignored the Fed’s relative softness last week and is fully capitalising on Europe’s weak indicators to increase growth.

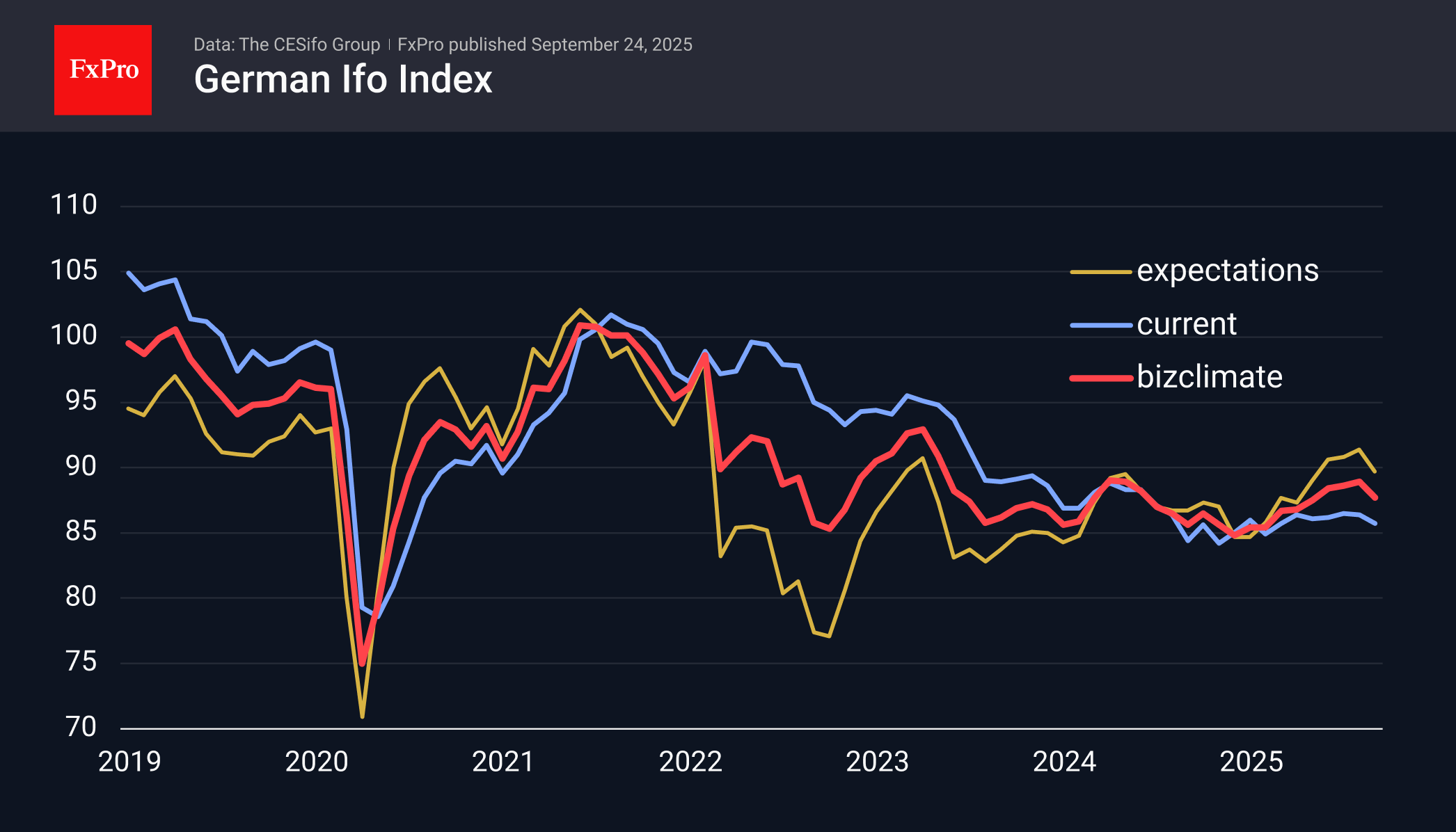

On Tuesday, the euro struggled to gain on mostly optimistic PMIs and accelerated its decline on the release of slightly weaker-than-expected Ifo indices for Germany.

The German business climate index interrupted the growth we have seen every month since December last year. This is likely a reaction of businesses to tougher trading conditions and disappointment with Merz’s lacklustre progress on stimulus measures.

Since early July, the EURUSD pair has been struggling with resistance at 1.1800, even though the ECB has stopped easing its policy and the Fed has only just begun. Fundamental pressure on the euro is coming from the deterioration in the trade surplus and the single currency’s sensitivity to risk appetite.

In addition, the euro has been climbing since the beginning of the year, based on speculation that tariffs will hit the US and that Germany’s stimulus measures will spur growth in the eurozone. Earlier this week, the OECD raised its global growth estimates for this year, thanks to the US and China. The inflationary pressure caused by tariffs turned out not to be as strong as previously estimated. We wrote about this at the beginning of the year, based on the effect of similar episodes in the past.

Suppose we continue to draw on this experience. In that case, we can expect a gradual increase (+10% over two years) upward trend in the dollar against the Euro due to a reduction in the trade deficit and an increase in investment flows to the US.

The FxPro Analyst Team