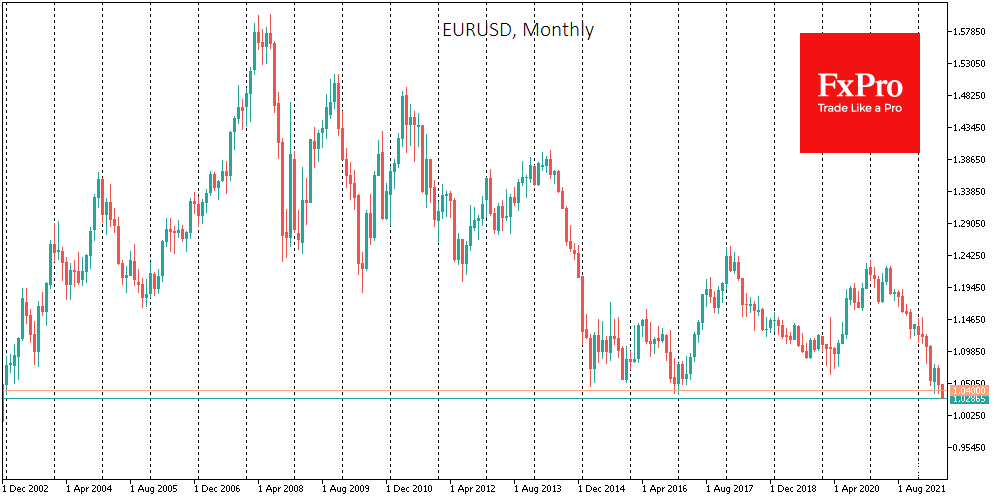

The single currency collapsed below 1.03 for the first time since December 2002. The 1.0350 area euro buyers have managed to defend three times in the last month and a half and at the end of 2016.

In our view, we should look for traces of the changed approach of the Swiss National Bank in that the euro has broken the dam. For the past seven years, the SNB has been active in the forex market as soon as the EURCHF weakening trend became sustained.

The SNB did not disclose any details, but in late February, it probably stopped the euro from falling below parity against the franc, at the end of last year, reversed it near 1.0370, and in March 2020, hedged it from declining below 1.05.

The rate hike last month was a public step in the fight against inflation, while the revision of the FX interventions policy was another covert turnaround by the SNB. Indeed, it would be naive to assume that the central bank would raise rates to fight inflation without abandoning the interventions that have protected Switzerland from deflation in previous years.

The SNB is thus no longer the last line of defence for the euro, leaving it alone with a melting trade balance and a widening gap between real and nominal interest rates.

And in this situation, euro buyers have nothing to cling to now other than expectations of weak US labour market data. The currency market may avoid a further sell-off in the euro until Friday’s statistics release. However, if it comes without unpleasant surprises, the next big stop for EURUSD could be around 0.99.

The FxPro Analyst Team