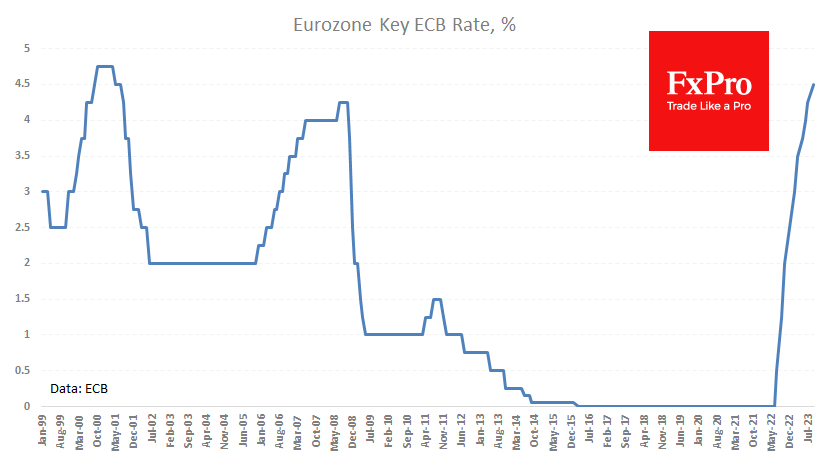

Though analysts anticipated no changes, the ECB raised the rate by 25 points to 4.5%. However, the ECB’s comments had a more significant effect on the markets. They stated that current rates are effective enough to normalise inflation eventually. This comment influenced the market as it was perceived as a hint that rates had reached their highest.

Madame Lagarde suggested future increases may occur during her press conference if inflation unexpectedly rises. However, the market’s response was clear: the euro fell drastically, nearing $1.0650, its lowest since March. The market then focused on the ECB’s reduced economic growth predictions and remarks on how quickly monetary tightening spreads through the economy.

The set of US data highlights contrasts with a sluggish eurozone with better-than-expected retail sales, producer prices, and jobless claims – all pointing to a better state of the economy. In contrast, the speed of interest rate transmission is slower than average here.

This divergence could be reasoned by homeowners in Europe borrowing at adjustable rates, whereas in the US, they favour fixed-rate loans. Debt costs for businesses and households in Europe are increasing faster.

The FxPro Analyst Team