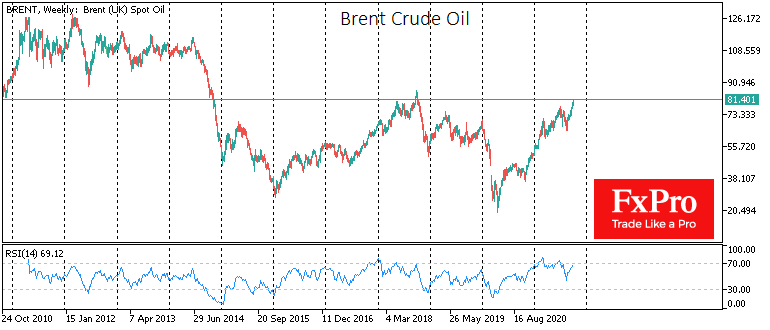

The energy price crisis is in no hurry to leave Europe. Exchange prices for gas have risen by a third in a month. Brent Crude is nearing $80 again while coal prices are updating multi-year highs. The energy price dynamic appears to be in its final phase. Thus, for the coming weeks, with some certainty, we can predict only the extreme levels of volatility, but not prices or even the direction of its movements.

Such spikes in fuel prices often slow consumption, while sellers, having resolved temporary logistical difficulties, actively increase supply, with longer-term consequences.

At one point in the coming weeks or even days, the oil, gas, and coal market may mirror the situation in April 2020, when oil prices were temporarily in negative territory, which became a turning point.

It looks equally dangerous for speculators in the market to open both long and short positions in the market right now, as price volatility looks a bit wild. However, it is still more prudent to expect a significant cooling in prices from the current inflated levels on the investor side.

The FxPro Analyst Team