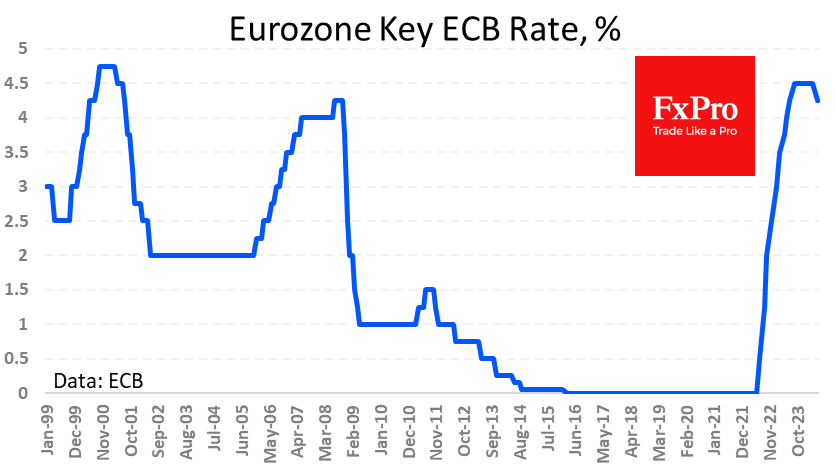

The European Central Bank cut all three of its key interest rates by 25 points, which is in line with market expectations. The ECB has kept rates unchanged for the past nine months and tightened policy from July 2022 to September 2023, raising rates by a combined 450 basis points.

In May, overall eurozone inflation added 0.2 percentage points to 2.6%. However, that didn’t stop the ECB, which has been preparing markets for months for today’s move. However, the move to ease ECB policy is supported by other data.

Producer prices have been falling every month for the past six months, and in April were 5.7% lower than a year earlier. This decline creates room for final retail prices to fall.

The euro-region economy is also on the side of the doves at the ECB, as GDP for Q1 2024 added 0.3% after two quarters of contraction at 0.1% and is now higher by a modest 0.4% y/y. This weak performance allows for little fear of inflationary risks from strong domestic demand. Rather than the opposite, Europe needs mild stimulus to avoid slipping further into recession due to tight policy.

The fall in prices of a wide range of commodities makes it unnecessary to fear a return of 2022-style inflation. However, recent trends in container shipping prices make us wary of a possible repeat of the logistical problems seen in 2020-2021.

It is almost certain that the ECB is not done with rate cuts this year, but whether we see two more rate cuts or more depends on inflation data. Current trends in inflation and economic activity are setting us up for the ECB to “reduce monetary policy tightness” faster than the Fed. This could be an important pressure factor for EURUSD, preventing the single currency from moving up from the wide range of 1.05-1.10, where the pair has been predominantly trading since the beginning of 2023.

The FxPro Analyst Team