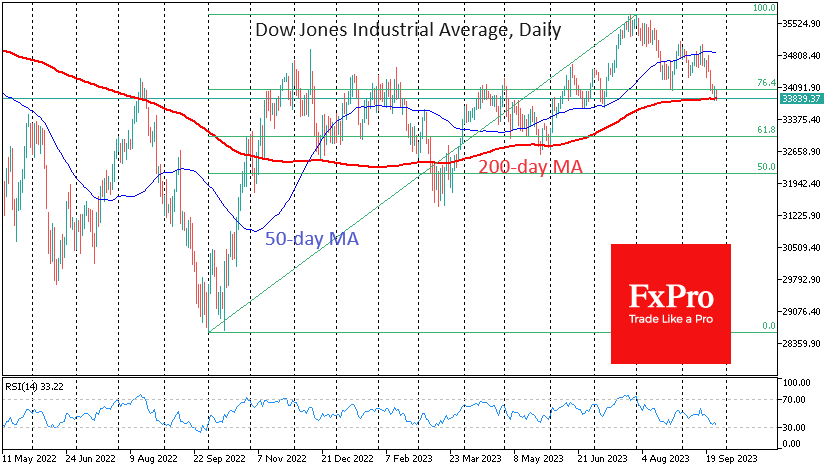

The Dow Jones Index is testing the long-term trend’s strength in the form of the 200-day moving average. The touching of this curve at the end of May and a brief dip below in March was characterised by increased buying. Are there enough buyers left in the markets to buy out the dive again? There are doubts.

The US Dow Jones has been trading below 34000 since the beginning of the week, back to the lows from early July, when we saw the last bullish attempt to warm up the market. Since August, the initiative has shifted to the bears, and they pretty quickly established a break of the medium-term trend in the form of the 50-day moving average.

Now, it is time to fight for the long-term trend in the form of the 200-day average. The German DAX40 and the pan-European Stoxx50 pulled back under those lines last week. Early last week, the Russell2000 – the broadest of the popular US indices – was also under this curve. And that only intensified the sell-off.

This week, the US Dow Jones – the oldest of the modern indices – is testing the strength of the 200-day moving average. Based on previous instances, a close under 33800 would open Pandora’s box, intensifying the sell-off.

In addition to breaking the uptrend, we will get confirmation that the market is on a deeper correction scenario, potentially heading for 33000 (61.8% of the October 2022 bottom to the July peak) after failing to cling to the 76.4% at 34000 (a shallower Fibonacci retracement).

We also note the change in the information backdrop. The pull away from risks, i.e. equities, is intensified by the disagreement on the budget, which could cause a US government shutdown. Fed officials are emphasising the chances of further interest rate hikes, while news media highlight the severity of current financial conditions for Americans.

This agenda reinforces the negative news backdrop, which could play into the hands of the bears in the short term, thus triggering a domino effect in another market benchmark.

The FxPro Analyst Team