The Dow Jones Industrial Average plunged more than 1,500 points on Thursday and was on pace for its worst day since the March sell-off as coronavirus cases increased in some states that are reopening up from lockdowns. Shares that have surged recently on hopes for a smooth reopening of the economy led the declines.

The 30-stock Dow traded 1,544 points lower, or 5.7%. The S&P 500 slid 4.5% while the Nasdaq Composite dropped 3.8%. Thursday’s losses also put the Dow on pace for its first three-day losing streak in a month. The S&P 500 was headed for its longest losing streak since early March.

“You’re seeing the psychology in the market get retested today” as traders weigh the the recent uptick in coronavirus hospitalizations and a grim outlook from the U.S. central bank, said Dan Deming, managing director at KKM Financial. “The sense is maybe the market got ahead of itself, which makes sense given the fact that we’ve come so far so fast.”

Traders dumped airlines, cruise operators and retailers after piling into those names over the past month amid expectations of a swift economic recovery. Shares of United Airlines, Delta, American and Southwest all dropped more than 9%. Carnival Corp. and Norwegian Cruise Line shares fell more than 14%. Gap and Kohl’s shares traded lower by 9% and 10%, respectively.

Instead, Wall Street fled back into stocks that have benefited from consumers staying at home during the pandemic. Netflix and Zoom Video, for example, rose 0.4% and 2.1%, respectively.

Concerns about a second wave of coronavirus cases have risen as U.S. states push deeper into reopening. Texas has reported three consecutive days of record-breaking Covid-19 hospitalizations. Nine California counties are reporting a spike in new coronavirus cases or hospitalizations of confirmed cases, AP reported Wednesday.

Both the S&P 500 and the Dow are still up more than 40% from the coronavirus low. The incredible comeback started with investors betting on technology companies like Amazon that were doing well despite the pandemic, but in the last month reopening bets like airlines have been the biggest gainers. Now investors are rotating back into those tech names and taking profits in the rest of the market.

Traders also sold oil futures contracts amid worries the global economic reopening will get sidetracked. West Texas Intermediate futures dropped 7.9% to $36.46 per barrel. In turn, traditionally safer assets such as bonds and gold rose. The 10-year Treasury note yield dropped to 0.67% and hit its lowest level in more than a week (yields move inversely to prices). Gold futures jumped 1.5% to $1,746.50 per ounce.

Thursday’s moves also followed the Federal Reserve warning on Wednesday the U.S. economy will contract by 6.5% in 2020 before expanding by 5% next year. The central bank also said it will keep rates at currently low levels through 2022.

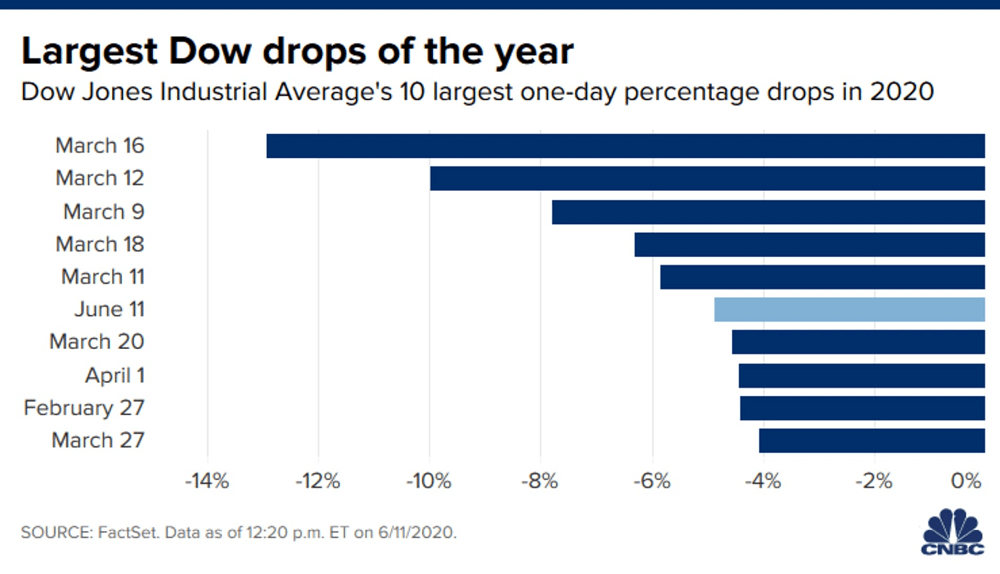

The Dow is now on pace for its biggest one-day loss since March, dropping 1,500 points, CNBC, Jun 11