Stock markets start trading on Friday at some distance from the highs of the week, as California announced curfews to try to stop the spread of the coronavirus. Even more disturbing was the news that US Treasury Secretary Mnuchin has asked the Fed to return the unused $455 billion allocated to the business lending programme to Congress to be reallocated.

The programme was not in great demand, but it was expected to be extended beyond the 31st of December. The winding down of this programme is causing markets nervousness on signs of a divided Fed and US Treasury.

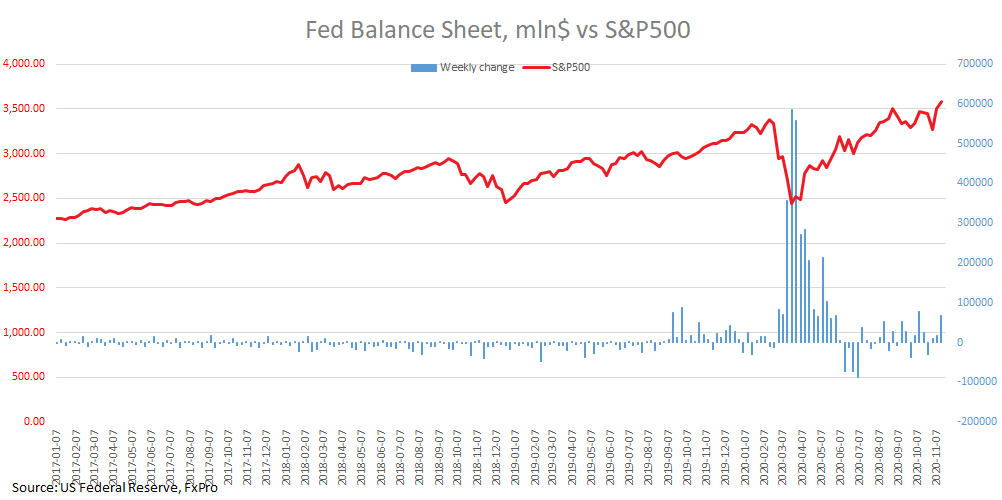

The Fed does its part by continuing to buy assets on its balance sheet. Published data showed a weekly increase of $67.7 billion, the second most significant weekly increase since May. Probably related to this is that the US indices were able to stay in line with the level of a week ago.

But only Fed-driven market growth is raising questions about the sustainability of the dollar. The dollar index fell for the second time this month to 92 and it was briefly below this at the end of August. The dollar index has not been steady below this level since April 2018.

The global retreat of the dollar is broken down into a series of local battles in individual currency pairs. EURUSD is once again getting closer to 1.1900. It looks like the last stronghold before 1.2000 and attempts of the pair to enter the next trading range of 1.2000-1.2400.

GBPUSD is close to 1.33, above which it has not consolidated since July 2018. Overcoming this resistance will open the path to the range of 1.33-1.43.

USDJPY is now slightly below 104, but as with the pound and the Euro, the pair is on the verge of breaking out of the trading range of recent years.

Interestingly, the volatility of the currency market remains moderate or is even slightly declining. Approaching the boundaries of established trading ranges is so far accompanied by gentle attempts to push the dollar back and nothing more.

It is interesting to see how events will develop further and whether or not there will be a sharp increase in volatility when taking important round levels. For the US, a mild retreat of the dollar could be considered a favourable scenario, especially if it does not lead to a steady increase in government bond yields.

The US government needs to accumulate new debt and service what has already been accumulated, so it would be more advantageous for the US government to have this combination of increasing competitiveness of exporters and higher inflation, combined with a steady demand for government bonds to insure low yields for longer.

The FxPro Analyst Team