After starting the week in retreat, the US dollar reversed sharply higher in the European session on Tuesday and is on the offensive on Wednesday. Dollar bulls have returned to active buying after a long but shallow correction from earlier this month’s peak.

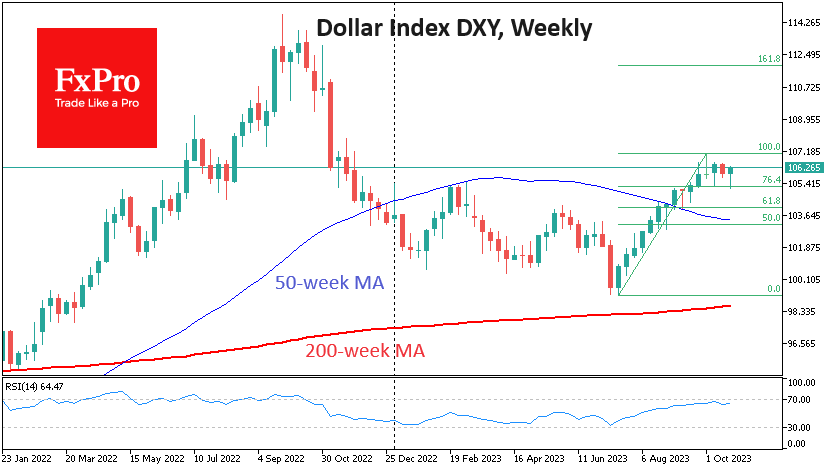

The Dollar Index peaked at 107 in early October after twelve weeks of gains. The market was then dominated by profit-taking. However, the pullback from the 107.1 peak was relatively shallow, and the DXY corrected 76.4% of the total upside amplitude, finding support at 105.2. Deeper corrections are seen as the norm, but there are truncated corrections in solid markets when there is sufficient reason to complete them.

On the news side, the reason for the resumption of buying in the US was the failure of the Eurozone PMIs. This starkly contrasted to the better-than-expected indices coming out of the US. These indices underlined that America is doing well with high interest rates, while Europe is losing traction, and its countries are likely to slip into recession one by one.

The technical reason for the sell-off was that the EURUSD touched its 50-day moving average as it approached 1.07. The dollar bulls did not let this vital trend indicator be taken away, proving once again that we are in a strengthening dollar environment.

The DXY index also approached its 50-day average but failed to touch it and was just minutes below its 76.4% retracement.

In general, it is too early to talk about a continuation of the dollar rally, and it is better to wait for confirmation in the form of an update of the previous local highs at 107.1.

However, the bulls have two critical factors on their side. First, the Carry trade – playing the interest rate differential – is now entirely on the side of US assets, not to mention the attractive liquidity and reliability of the US market.

Secondly, we note the strong dollar buying impulses on Tuesday and 12 October, suggesting impressive demand on the downside.

Thus, barring any surprises from macro data and next week’s FOMC meeting, it is only a matter of time before the Dollar Index reaches new highs.

The FxPro Analyst Team