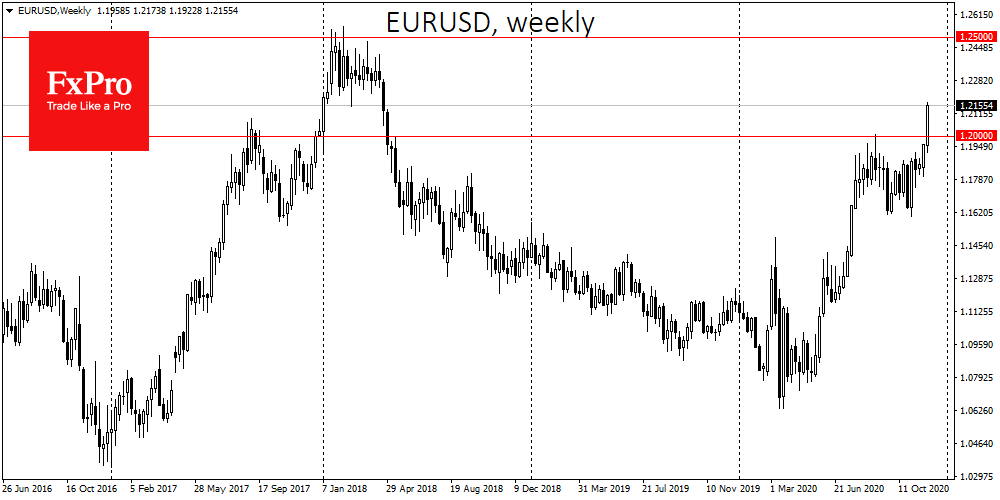

The dollar started December with a sharp weakening. At the very beginning of the month, EURUSD crossed 1,2000, after which the fall of the dollar began to gain momentum. The Euro broke out of its trading range at 1.16-1.20, where it had spent the last four months, and saw little significant resistance on the way up to 1.25. Given the current pace of dollar’s weakening and the lack of substantial resistance between 1.20 and 1.25, EURUSD may reach the upper bound at 1.25 in a matter of weeks.

As with the Euro, the Pound is testing the upper limit of its trading range. In the last two years, GBPUSD has traded above 1.35 for just a few hours. Breaking through this level may result in an increase in dollar selling and support purchases of the Pound, targeting it at 1.42 by the end of Q1 2021.

The growth of the Swiss Franc is even more telling. Earlier this week the dollar fell to its lowest level since January 2015 against the Franc. Interest in the latter is so strong that it allows the CHF to add more against the single currency.

The Japanese yen has been adding much more modestly since the beginning of the month. USDJPY remains at 104, which is inside last month’s range. Demand for risk fuels the sale of bonds in yen to buy more yielding assets in other currencies.

The fall of the US currency against major competitors is mirrored in the weakness of the dollar index (DXY), which has lost 3.7% since the beginning of November and is less than 2.5% above the lows of early 2018.

The Chinese yuan also returned to growth in the new month after a pause at the end of November, having updated two and a half year highs against the dollar and trading below 6.52 yuan.

The Fed and the US Treasury are strong enough to prevent the dollar from falling, but will they do so for the foreseeable future? It is unlikely that they will. The decline of the dollar to 2 or even 5-year lows is not yet a significant concern for financial markets. Yet investors do not demand substantial premiums for buying American bonds. Moreover, their yields, including risky corporate debt securities, remain close to historical lows.

The fed will continue to turn a blind eye to the side effects of a weaker USD for the time being, as this is a benefit to stock and commodity markets, a catalyst for overall macroeconomic activity and increased competitiveness for US export.

The FxPro Analyst Team