- The Fed does not rule out a rate hike.

- The pound continued to fall amid slowing inflation.

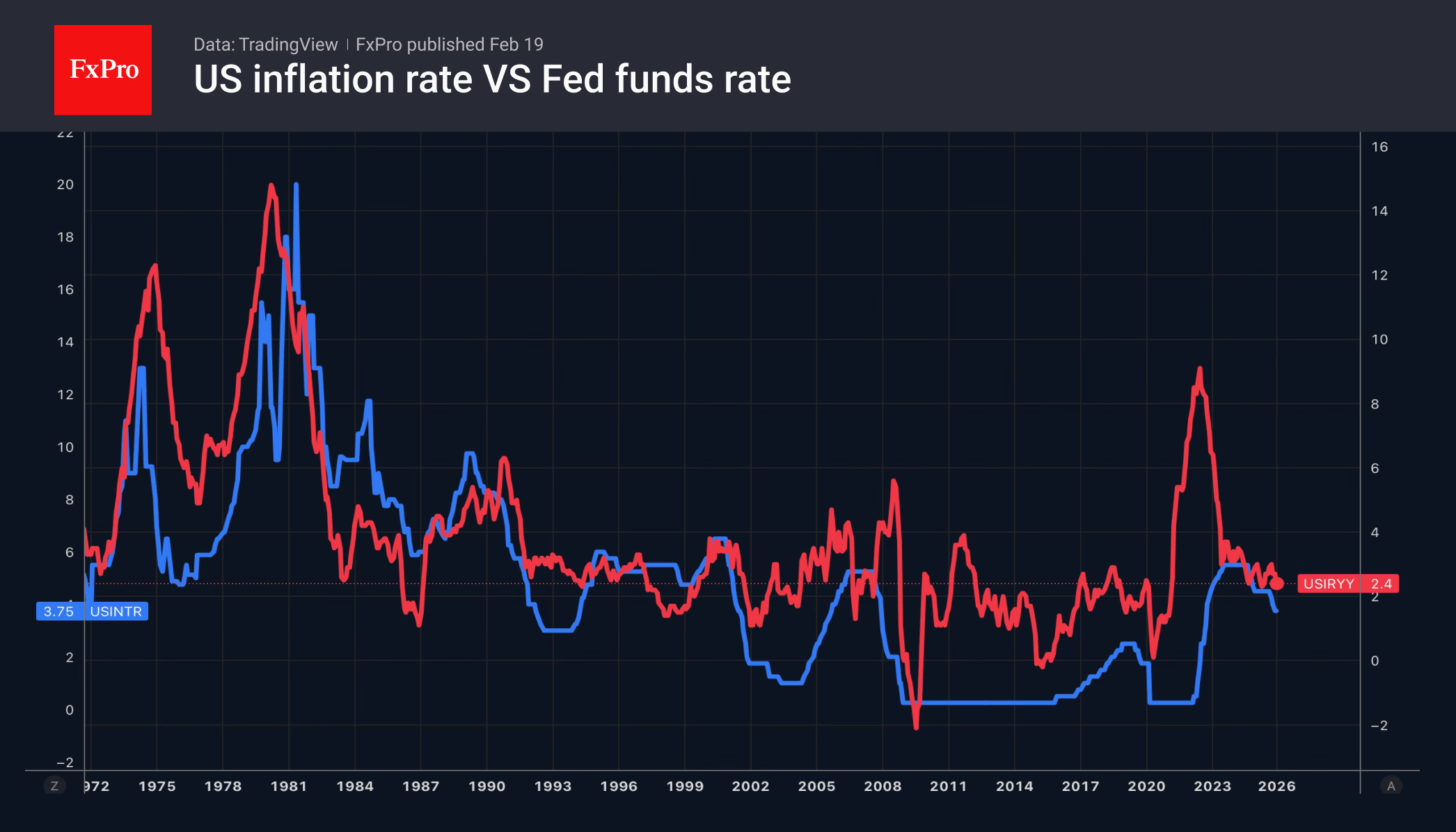

The ‘hawkish’ surprise in the latest FOMC minutes helped the US dollar. Members wanted to see more progress towards the 2% inflation target to resume the rate cut cycle. In their view, the risks of a cooling labour market have decreased, while the dangers of accelerating higher inflation remain high. However, investors were much more impressed by the wording about a possible increase in the federal funds rate if inflation does not slow down.

The futures market lowered the chances of the Fed easing in April from 25% to 21% and in June from 63% to 61%. Coupled with a 0.6% increase in core durable goods orders in the US in December, this allowed EURUSD bears to launch a new attack. At the same time, the futures market remains confident in two Fed rate cuts in 2026 and prices a 40% probability of a third. This situation suggests a bullish outlook for the euro in the medium term, even though the dollar’s chances for the near future look more favourable.

That is, of course, unless the mood of EURUSD fans is dampened by the story of Christine Lagarde’s early resignation. Rumours have spread across the market that she will leave her post before the new presidential elections to give current President Macron more room to choose a successor, as she is afraid that the next President might be from the right party, which may damage the authority of the central bank and also the euro.

The slowdown in consumer prices in Britain to a 10-month low of 3% has accelerated the decline of GBPUSD. Although CPI and core inflation were slightly higher than the BoE’s forecasts, they are expected to reach the 2% target by April. This allows the futures market to expect at least two cuts. The first reduction in the repo rate is likely to take place in March. The narrowing of the spread with the federal funds rate is contributing to the fall of the pound against the US dollar.

The recovery of US stock indices, the associated increase in global risk appetite and the rally in Treasury yields have dealt a real blow to the yen. USDJPY bulls are armed with expectations of Sanae Takaichi’s first steps after the Liberal Democratic Party’s convincing election victory. It is not a given that the prime minister will pursue fiscal consolidation.

The FxPro Analyst Team