The dollar continues to rise on speculation of policy changes following the US election. The Dollar Index rose above 105.5 on Monday – its highest level since early July – before easing slightly in trading.

The main contributors to the index’s strength are weakness in the single currency and the Japanese yen. In both cases, there is a cocktail of political uncertainty and fears that Trump’s protectionist policies will hurt EU and Japanese exporters.

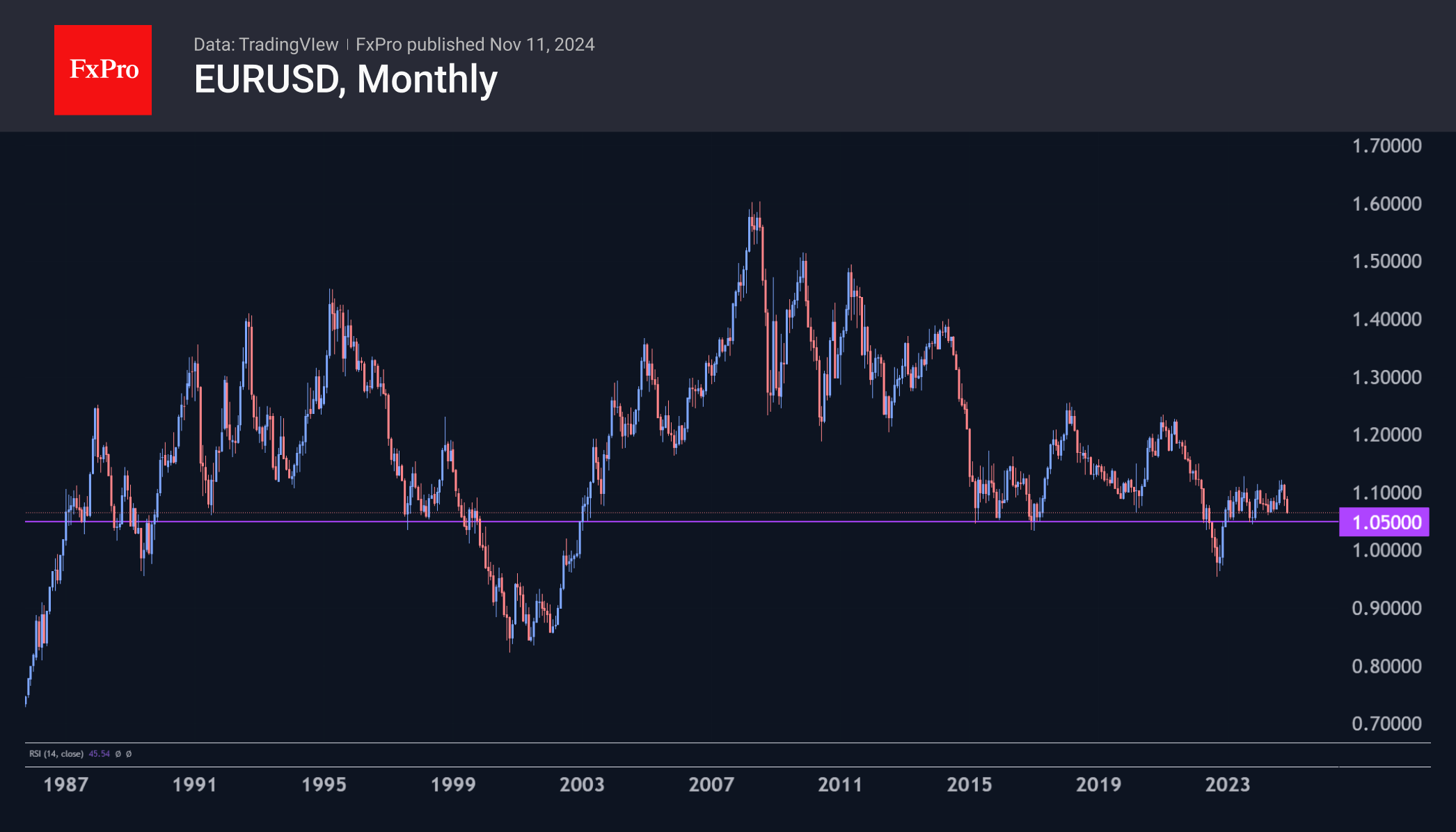

The EURUSD has pulled back to the 1.0650 area. Over the past 12 months, it has only traded below this level for a few days in April. The pair reversed sharply from the 1.20 area after the so-called Trump trade began in early October.

Now that the Republicans have indeed come to power, we should expect further declines in the pair. The next important milestone on the way down is the 1.05 area, where we should expect a global shakeout, as this is historically the most important pivot area for the EURUSD. In 2022 and 2000, a break below 1.05 opened the door to a move well below parity. Conversely, if the EURUSD bulls can defend this level, the rally could be long and high.

USDJPY jumped 0.8% on Monday, back to last week’s local highs at 154. The pair has risen more than 10% from the mid-September lows and has made intra-week highs for ten consecutive weeks. The drivers were first disappointed with the pace of monetary tightening, then the Trump trade. Political reshuffles following the surprise defeat of the ruling party and uncertainty about further rate hikes have also played a role.

If we consider the 14% drop in USDJPY from 162 to 139 as a correction of the rise since the beginning of 2020, the new upside momentum promises to end closer to 200. However, only the passivity of the Treasury and the BoJ in breaching the 162 level will confirm the end of this monumental scenario.

The FxPro Analyst Team