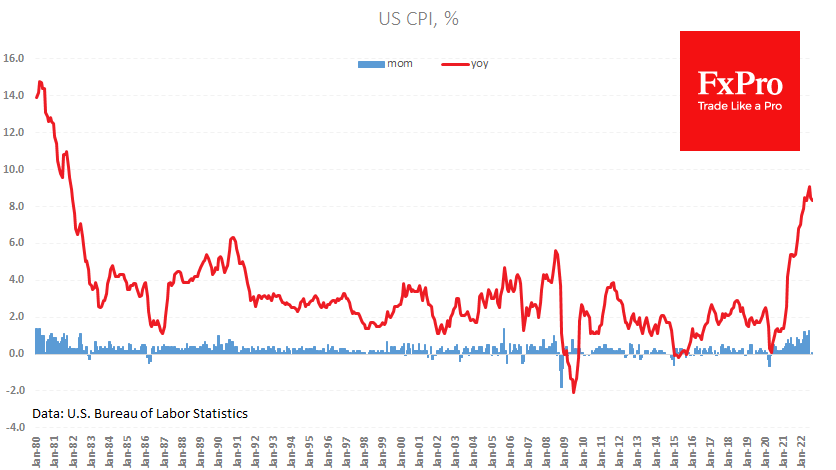

US inflation turned out to be wider and hotter than expected, confirming markets for another 75-point rate hike next week. Published data showed a 0.1% increase in prices for August, against expectations of a decline of the same magnitude. Annual inflation slowed from 8.5% to 8.3% but was better than the 8.1% forecasted.

Most of all, the markets were spooked by the surge in the core index. It added 0.6% over the month, to an annual rate of 6.3%, signalling inflation is spreading beyond energy and food.

The inflation roots set the stage for a stiffening response from the Fed. Almost immediately after the report, the swap market plotted a 100% probability of a rate hike of 75 points in a week. Risk assets have been vulnerable as the currency and stock markets have retreated from extremes over the past week. The dollar, meanwhile, has decisively returned to the upside.

The S&P500 futures are losing almost 3% immediately after publication, and the Nasdaq100 is down 3.5%, erasing virtually all the gains from last Friday. The Dollar Index adds 1.6% to the day’s lows, hitting 109.48. Once again, the 50 SMA acts as the basis for renewing longs after a brief shake-out.

Tomorrow starting the week-long silence period for the Fed before the next policy meeting, which will leave the markets on their own assessments. In such an environment, the USD index is well placed to make new 20-year highs within just a few days.

The FxPro Analyst Team