- The acceleration of foreign economies will weaken the US dollar.

- The USD index may fall another 13.5%.

- GBP is pressured by political uncertainty.

- Verbal interventions are not helping the yen.

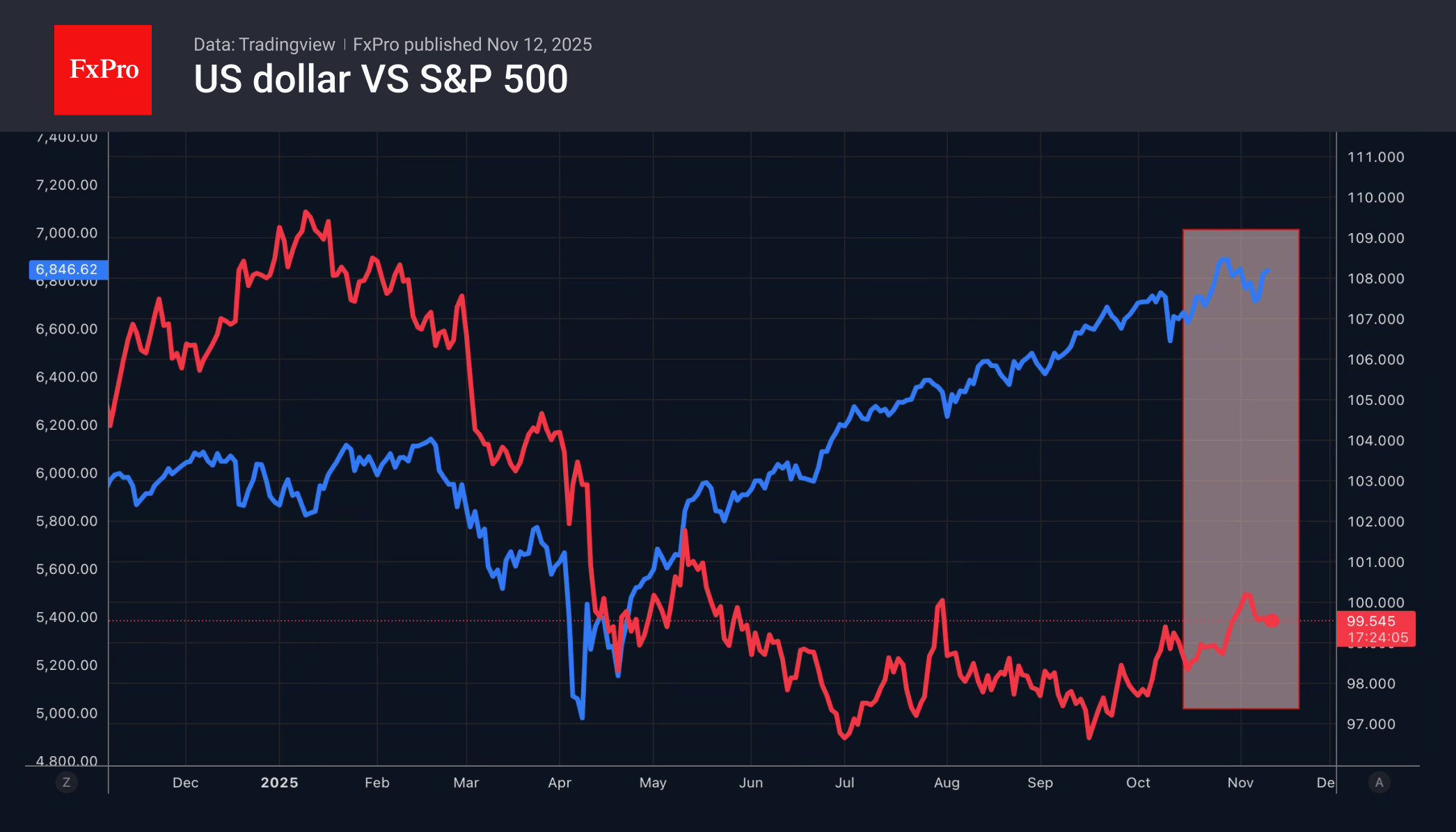

The dollar index fell on Tuesday following the release of ADP labour market data, which showed a decline in private sector employment of 50,000 over the past four weeks. However, rising stock indices gave the greenback a helping hand. Low volatility and good risk appetite allow carry traders to earn good returns on high US debt market rates. As a result, a direct correlation has developed between the S&P 500 and the dollar, a relationship that is not commonly observed.

According to the dollar smile theory, the USD strengthens when the US economy is either performing well or poorly. When there are non-critical problems, it tends to weaken. Currently, there is a combination of labour market weakness, stable consumer spending, and high inflation.

Eurizon Capital believes that the dollar has suffered from capital flight from the United States so far due to the uncertainty surrounding Donald Trump’s policies. However, the acceleration of foreign economies, particularly against the backdrop of a soft landing in the US, will accelerate the process of money transfer. As a result, the USD index is expected to continue falling, losing another 13.5% during Trump’s presidency.

In fact, further dynamics in the currency market will depend on new data and decisions by the Fed. The split within the central bank is causing the futures market to doubt a cut in the federal funds rate in December and is supporting the bears on EURUSD.

The pound has even more problems, which is putting pressure on GBPUSD. The trade-weighted pound fell to its lowest level since January on data showing rising unemployment and slowing investment growth. Budget problems hang like a sword of Damocles over the pound, and now there is information that some of Prime Minister Keir Starmer’s party colleagues are seeking to remove him from office in December. Politics often has a visible impact on the pound, and it is often negative.

The Japanese government’s increasingly vocal interventions are not stopping the bulls on USDJPY. According to Finance Minister Satsuki Katayama, the negative consequences of the yen’s weakness for the economy outweigh the positive aspects.

The FxPro Analyst Team