The dollar’s wide sale continues. Except for Crude oil, the American currency gives up its positions against a wide range of assets. Gold surpassed the price of $2000 per troy ounce for the first time in history, Nasdaq100 closed on Tuesday at historic highs, Dow Jones 30 added 0.6% and S&P 500 rose by 0.4%.

Among the significant moves on FX is the decline of the dollar against the renminbi to 6.96, the lowest since March, and return of AUDUSD to its 1.5-year highs above 0.7180.

The combination of rising markets and currencies of China and Australia clearly indicates that fear of trading disputes with China is not the reason for the weakening dollar, as in this case, AUD and CNH often lose the most.

Overnight, some progress was announced regarding the trade agreement. However, assurances that trade negotiations continue should hardly be considered as significantly positive. After more than two years of talks, investors are watching how quickly the situation is deteriorating rather than hoping for a breakthrough.

The timing of the sharp weakening of the dollar is worth paying attention to. The primary pressure this week came amid the American sessions. With the number of Coronavirus sufferers approaching 5 million, it seems like the Americans are throwing their most efforts into flattening the wrong curve.

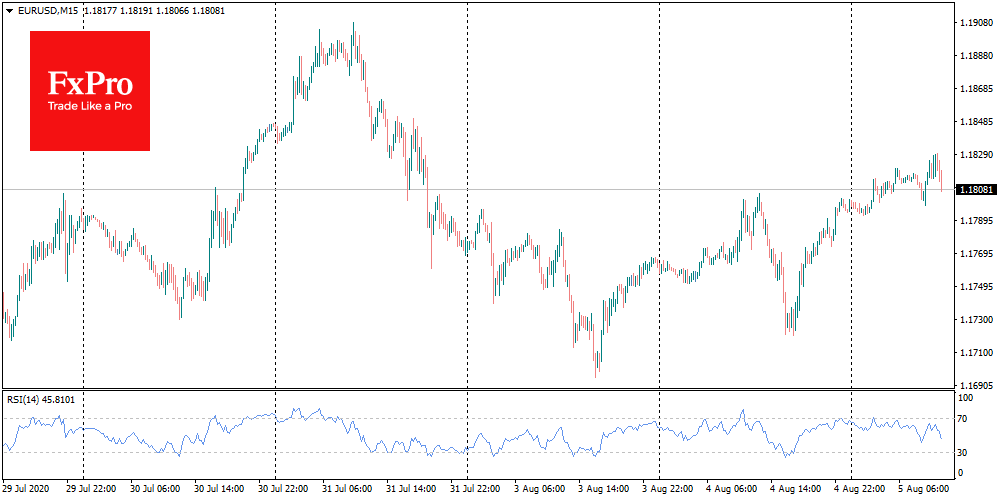

Fed policymakers started talking about the need to expand support through new policy easing, which supported the appetite for risky assets. The yield curve for US treasuries has been flattening for months. It is nearing zero in bonds with ever more distant maturities recently.

This is a signal that there is enough dollar liquidity in the US, and investors are looking for ways to generate profit outside the US. With budget and trade deficits, this could turn into a significant outflow of capital from the country and seriously harm the dollar.

It is also worth noting that yesterday the majority of US government bonds showed some uptick in yield. It is dangerous for this trend of simultaneous decline in the currency and increase in yields, as was observed during the debt crisis in Europe.

The FxPro Analyst Team