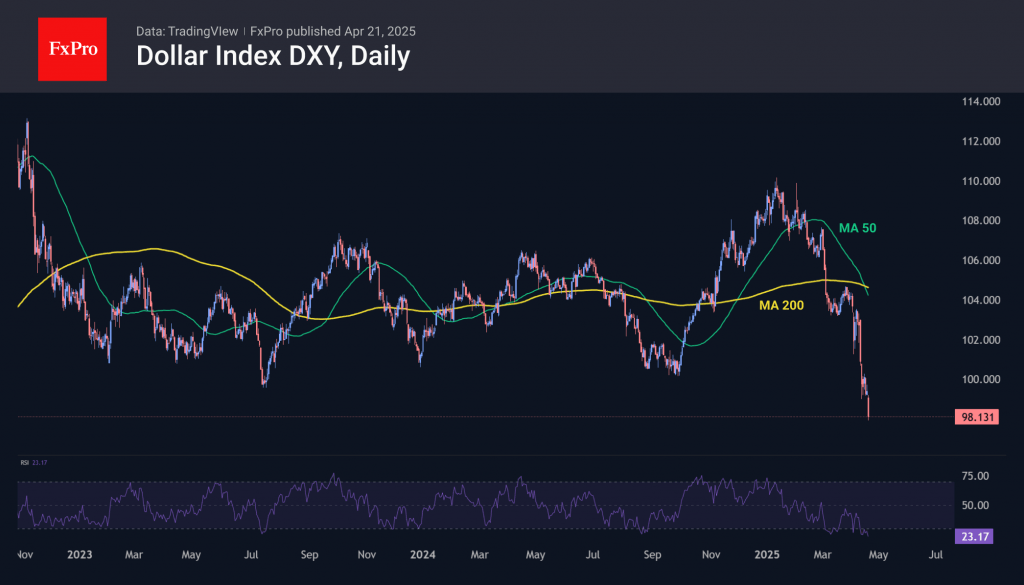

After four consecutive weeks of decline, the dollar index started the new Monday by continuing its move into the territory of three-year lows. Once again, a worrying sign is that this dollar weakness is not translating into buying in stocks or bonds — their indices are also losing ground.

From a technical standpoint, the dollar index has broken through the 161.8% level of the initial impulse from the highs at the start of the year to a significant pause in early March. The DXY received little to no support around the 99–100 area, which had triggered reversals over the past two years.

The dollar index is now trading around the same levels it held during the second half of Trump’s previous presidential term, from 2018 to the first half of 2020. On the daily timeframes, the RSI is showing the deepest oversold conditions since July 2020, and on the weekly chart — since 2017.

Although this setup creates favourable conditions for a rebound, previous instances have led not to a full reversal but to consolidation and further decline. A confident break below the 200-week moving average underlines the strength of the current sell-off.

In the history of free-floating forex markets — roughly the past half-century — the current situation on the long-term charts could be only the third similar case, following the episodes of the mid-1980s and early 2000s. In those cases, peaks in the dollar were followed by two and six years of decline, shaving off 45% and 40% respectively. In both instances, the dollar went on to update its historical lows, while a major side effect was global recession and a serious downturn in financial markets.

Focusing solely on the implications for the US currency, a repeat of the 1980s and 2000s patterns suggests a potential move below 70, although this could take years. A more immediate and realistic target for bears is a pullback towards the 90 area on the index, where reversals took shape in 2018 and 2020. A gradual decline, akin to the 2002–2008 period, appears more likely than a near-vertical collapse reminiscent of the 1980s. Along the way, prolonged consolidations and even substantial rebounds are possible.

The FxPro Analyst Team