- The US dollar weakened significantly in 2025, and its fate depends on central banks.

- The ECB will have a reason to intervene, while the Bank of England and the Bank of Japan may not rush into action.

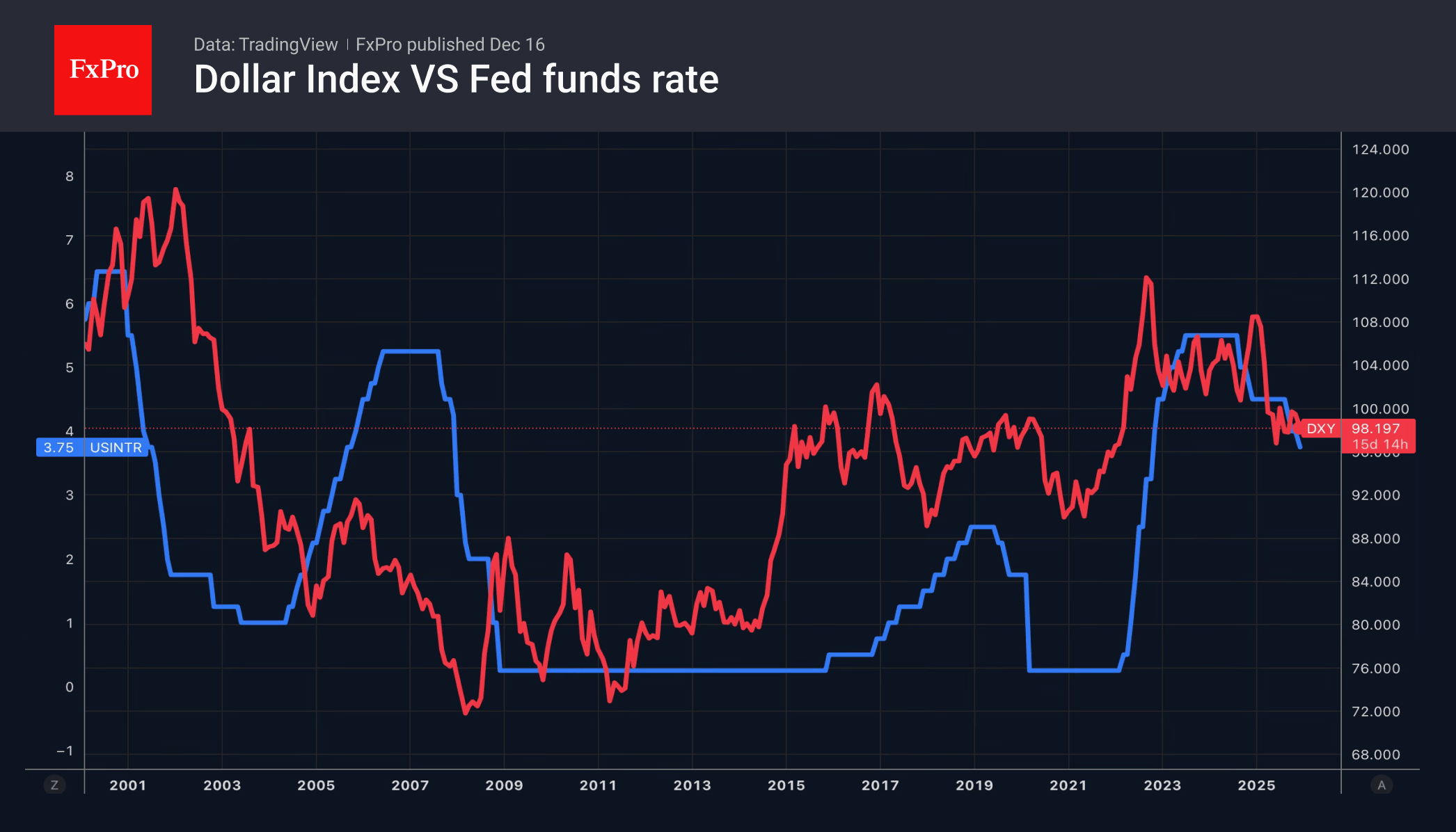

This year risks being the worst for the US dollar since 2017. Since the beginning of 2025, the DXY has lost about 9.5% and is likely to continue falling due to divergences in monetary policy. Major central banks are holding and raising rates, while the Fed intends to continue cutting them.

The fate of the US dollar depends on the scale and speed of these changes. The latest FOMC forecasts indicate only one rate cut in 2026, whereas the futures market anticipates two. If this number increases under the influence of data and pressure from the White House on the Fed, the dollar index is likely to decline. Donald Trump wants to see borrowing costs at 1% or below and is choosing between two Kevins. Kevin Warsh’s chances of becoming Fed chair have risen to 49%, while Kevin Hassett’s chances have fallen to 37%, according to the Kalshi forecasting platform. Polymarket gives figures of 45% and 42%, respectively.

Derivatives predict a 53% probability of the Fed resuming its monetary easing cycle in March. However, the central bank’s next move on interest rates depends on employment statistics. Investors are eagerly awaiting the BLS reports for October and November. The figures are likely to be mixed, but the trend is essential for the Fed. The revision of previous data will also be necessary. According to Jerome Powell, official statistics may overestimate job creation by 60K per month. This means that since April, there may have been a reduction of 20K in non-farm payrolls.

Other central banks will take US labour market statistics into account. This will affect the US dollar. Its weakening will lead to an increase in the exchange rates of the euro, pound, and yen, and slow down inflation in the eurozone, Britain, and Japan. As a result, the ECB may start using verbal interventions to put a spoke in the wheel of the EURUSD bulls. The BoE and BoJ will have the opportunity to normalise monetary policy slowly.

The Bank of England’s snail’s pace is having a positive effect on GBPUSD. Investors are expecting two easing measures, in December and at some point in 2026. The proximity of the end of the cycle is allowing the pound to spread its wings.

The FxPro Analyst Team