Political crises in France and Japan have undermined the strength of the US dollar’s main competitors, the euro and the yen. The resignations of the French and Japanese prime ministers and Paris’s move towards parliamentary elections are temporarily allowing the dollar to forget about monetary policy. The chances of further steps to ease Fed policy are growing rapidly after a record revision of employment data for the year in March, which took 911K jobs off previous estimates, and an unexpected decline in producer price indices for August.

A federal court ruling allowing Fed member Lisa Cook to attend the September FOMC meeting is helping the US currency. Donald Trump wants to weaken the US dollar, so any failure by the president serves as a signal to buy the US currency. This includes as part of the strategy of trading the Fed’s independence.

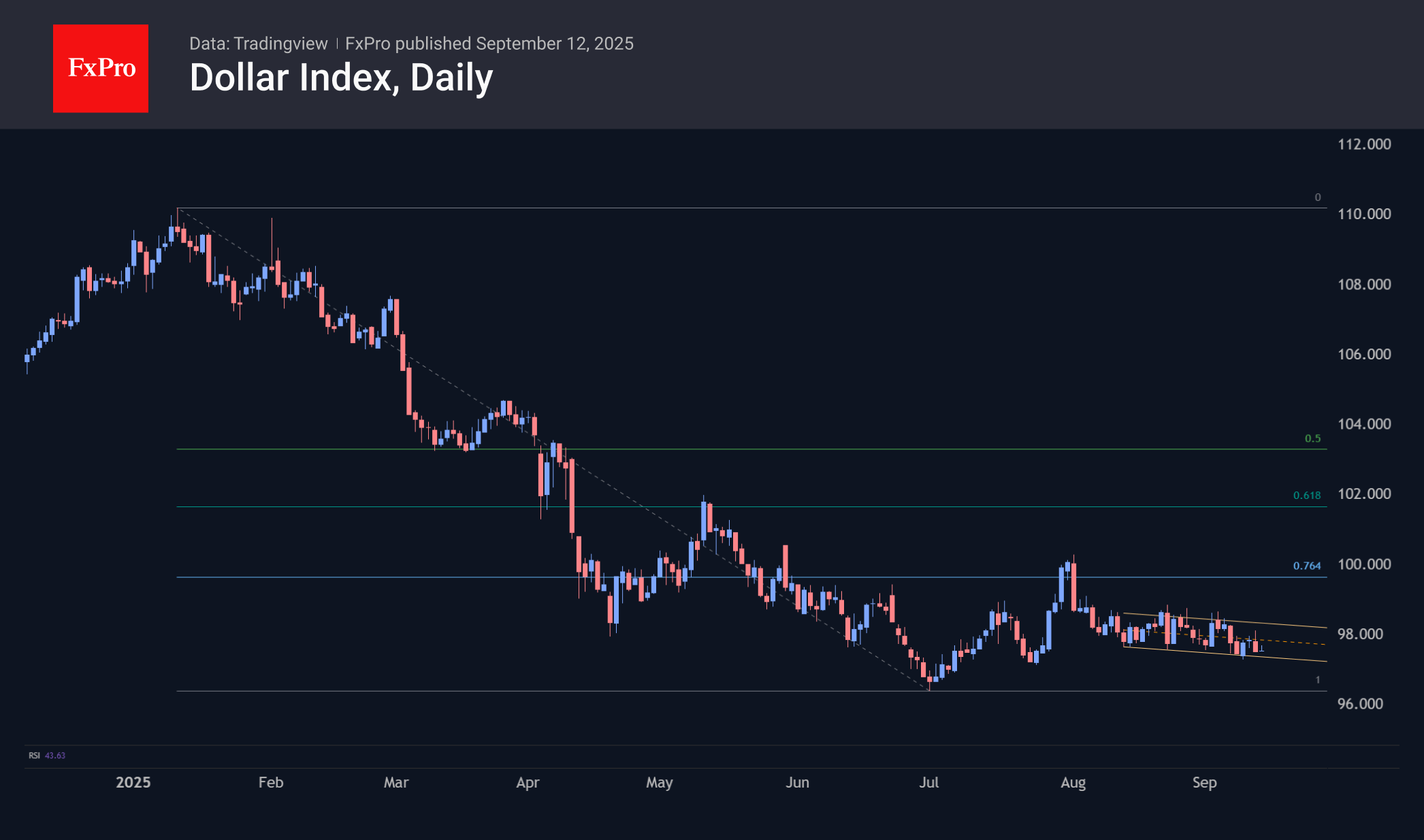

The dollar index has barely moved from the narrow range of 97-98 over the past five weeks. This tug-of-war replaced the six-month downtrend and the subsequent attempt to rebound in July. In this case, the sideways movement is a bearish signal. In the medium term, the current dynamics may turn out to be a corrective rebound, and its insignificant swing, not even reaching the typical 76.4% of the initial decline, is an indication of the strength of sellers. At the same time, the dollar found itself at the support level of the 13-year uptrend line, and even remaining at the same level leads to a fall below this line.

Given the growing expectations that the Fed will conduct a series of 4-5 rate cuts, while other central banks are not expected to follow suit, we have fundamental grounds for the dollar to resume its decline at the beginning of the new financial year.

During periods of global expansion, the US currency is under pressure due to increased demand for risky, higher-yielding assets outside of US government bonds. In similar conditions in the past, unexpected and sudden problems have saved America, including the dollar and government bonds, from a self-sustaining spiral of selling.

These included the more severe consequences for economies outside the US in response to the 2008-2009 financial crisis and the 2010-2011 sovereign debt crisis in Europe, which had repercussions for many years. Later, in 2018, the dollar gained on trade wars and in 2021 on the Fed’s ability to raise rates aggressively.

All these cases have in common the rush to the dollar during periods of acute crisis. Such a crisis would play into the hands of the US government, allowing it not only to legitimise rate cuts but also to simultaneously reduce the cost of borrowing by increasing demand for it.

The FxPro Analyst Team