- Tariffs have changed the status of the dollar, and the Fed may help it.

- The ECB and RBA could hike rates in 2026.

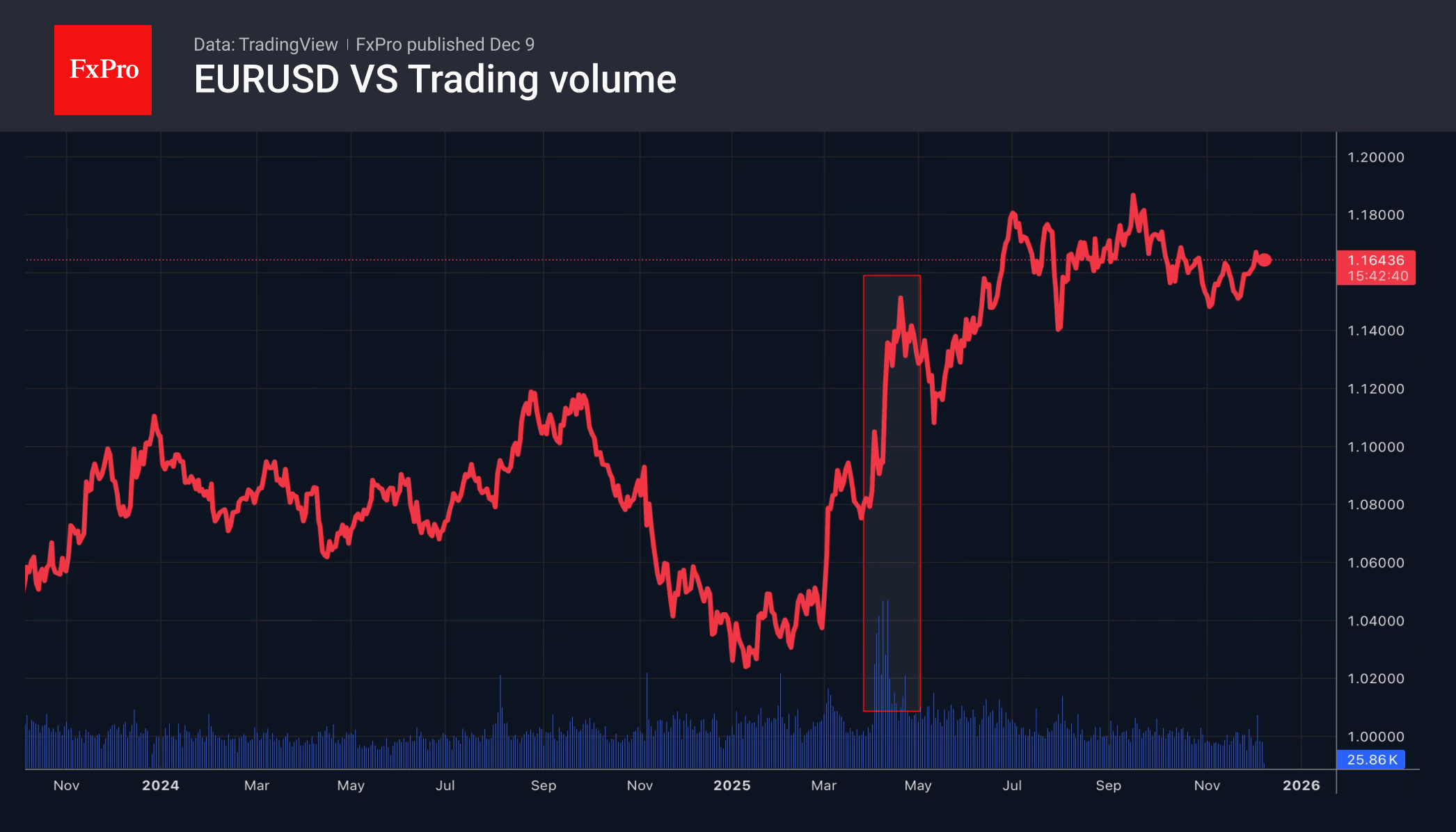

The US dollar has lost its status as a safe-haven asset. Investors were shocked by the size of Donald Trump’s tariffs and only started hedging their currency risks after the fact. As a result, daily trading volumes on Forex jumped to a record $9.5 trillion per day in April. The dollar index fell 10% in the first half of the year and then recovered only part of its losses. When the US began to establish trade relations, the degree of uncertainty decreased significantly.

Nevertheless, according to the Bank for International Settlements, hedging ratios are still low, and central banks’ rate cuts are reducing the cost of risk insurance. As a result, the US dollar is becoming vulnerable to new shocks.

The imminent arrival of a ‘dove’ and a White House figure in power is preventing the US dollar from strengthening ahead of the FOMC meeting. The baseline scenario is a 25-basis-point cut in the federal funds rate, followed by hawkish rhetoric from Jerome Powell and forecasts of two more cuts in 2026, compared to the three cuts recently priced in by the futures market. This scenario would create tailwinds for the greenback.

Its competitors are not resting on their laurels. The euro received a dose of optimism thanks to hawkish comments from ECB member Isabel Schnabel. The German said that market expectations of a rate hike are justified. The eurozone economy is expected to accelerate under the influence of Germany’s fiscal stimulus, increased EU defence spending, and improved domestic demand. In the derivatives market, the likelihood of a rate hike by the end of 2026 has risen to 33%.

The Australian dollar is trading at its highest level since mid-September, following the RBA’s decision to leave its key rate unchanged at 3.6% for the third consecutive time. At the same time, the bank’s governor, Michelle Bullock, said that the economy does not need easing. Inflation expectations have shifted upwards, and officials discussed what could lead to rate hikes in 2026. The futures market raised the start of the rate hike cycle to May from 50% to 90%, which drove up the AUDUSD quote.

The FxPro Analyst Team