- Market fears did not materialise

- The shutdown helps the US dollar

- The yen became October’s outsider

- The Bank of England may cut rates

October was the second-best month of the year for the US dollar. The weakness of its main competitors, the hawkish rhetoric of the Fed, the continuing rally in stock indices and the confident US economy allowed the dollar index to record its strongest performance since July. The main outsiders among the G10 currencies on Forex were the Japanese yen and the British pound.

In the first half of the year, the US dollar lost about 10%. Investors believed that tariffs would accelerate inflation and slow economic growth. Coupled with Donald Trump’s pressure on the Fed, this would lead to an aggressive cut in the federal funds rate and capital flight from the US stock market. All these gloomy forecasts are slow to materialise. This allows investors to return to the greenback.

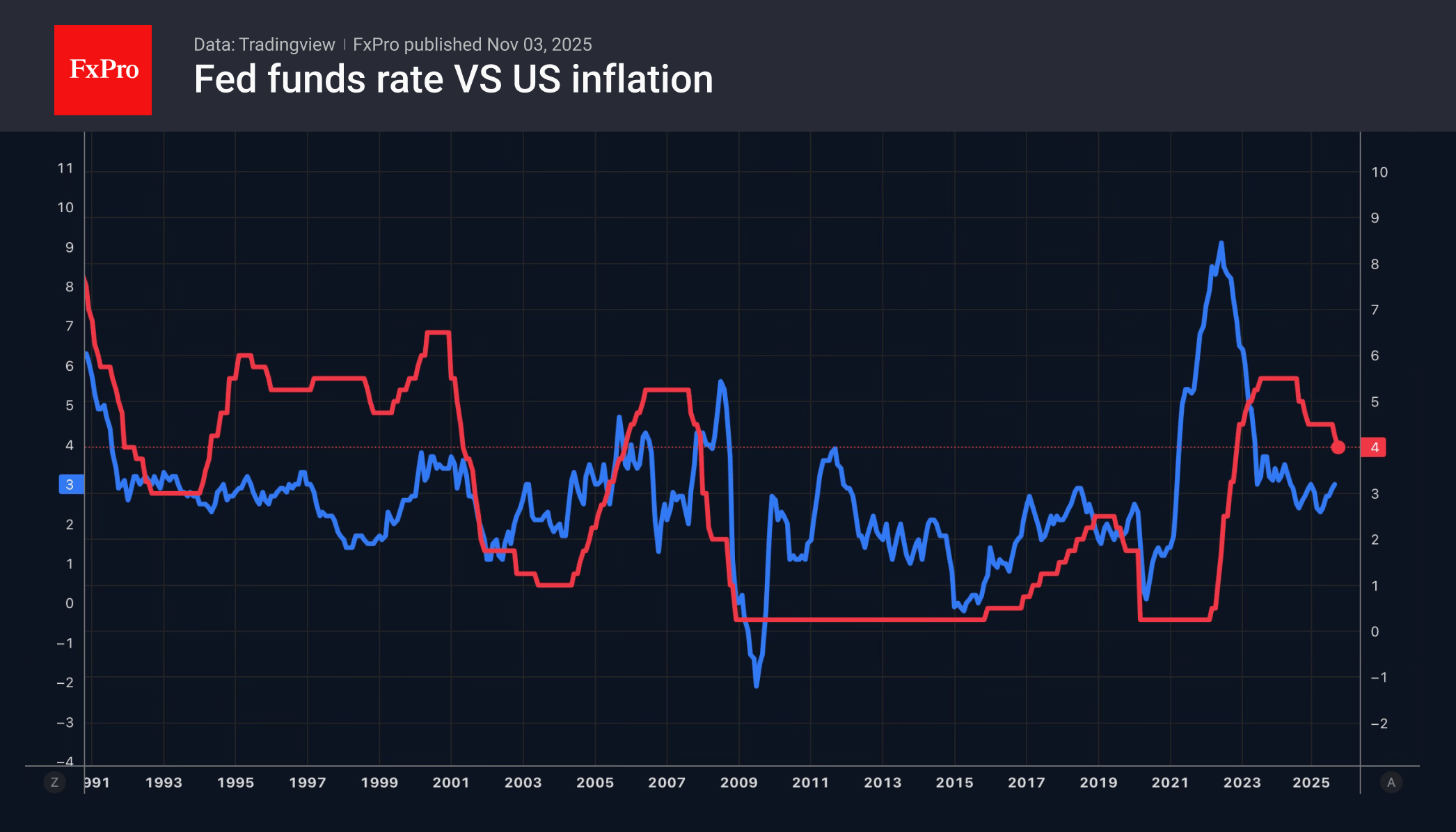

According to Jerome Powell, the Fed will not rush to cut rates. The shutdown is forcing the central bank to be cautious. The government shutdown could be the longest in history. The longer it lasts, the less likely it is that rates will be cut in December, which is better for the dollar.

Pantheon Macroeconomics believes that the reasons for the resilience of the US economy lie in lower tariffs. Nominally, the average rate exceeds 17%. In fact, companies pay about 12.5%. Currently, tariffs generate approximately $34 billion per month, or around $400 billion per year, for the American budget. Scott Bessent previously stated a figure of between $500 billion and $1 trillion.

The yen weakened due to the Bank of Japan’s reluctance to raise rates. Investors fear that this is happening under pressure from the new government. The pound is losing ground due to fears of imminent tax increases and government spending cuts. The Treasury needs to plug a £35-40 billion hole in the budget. In fact, it may turn out to be even bigger. As a result, GDP growth will slow down, and the Bank of England will be forced to ease its monetary policy.

Goldman Sachs is calling on the BoE to cut rates at its meeting on 6 November. The futures market estimates the chances of this outcome at 1 in 3. At the same time, the split in the MPC signals that the central bank may indeed return to cutting rates. As a result, GBPUSD fell below 1.31 at the end of the week, its lowest level since April.

The FxPro Analyst Team