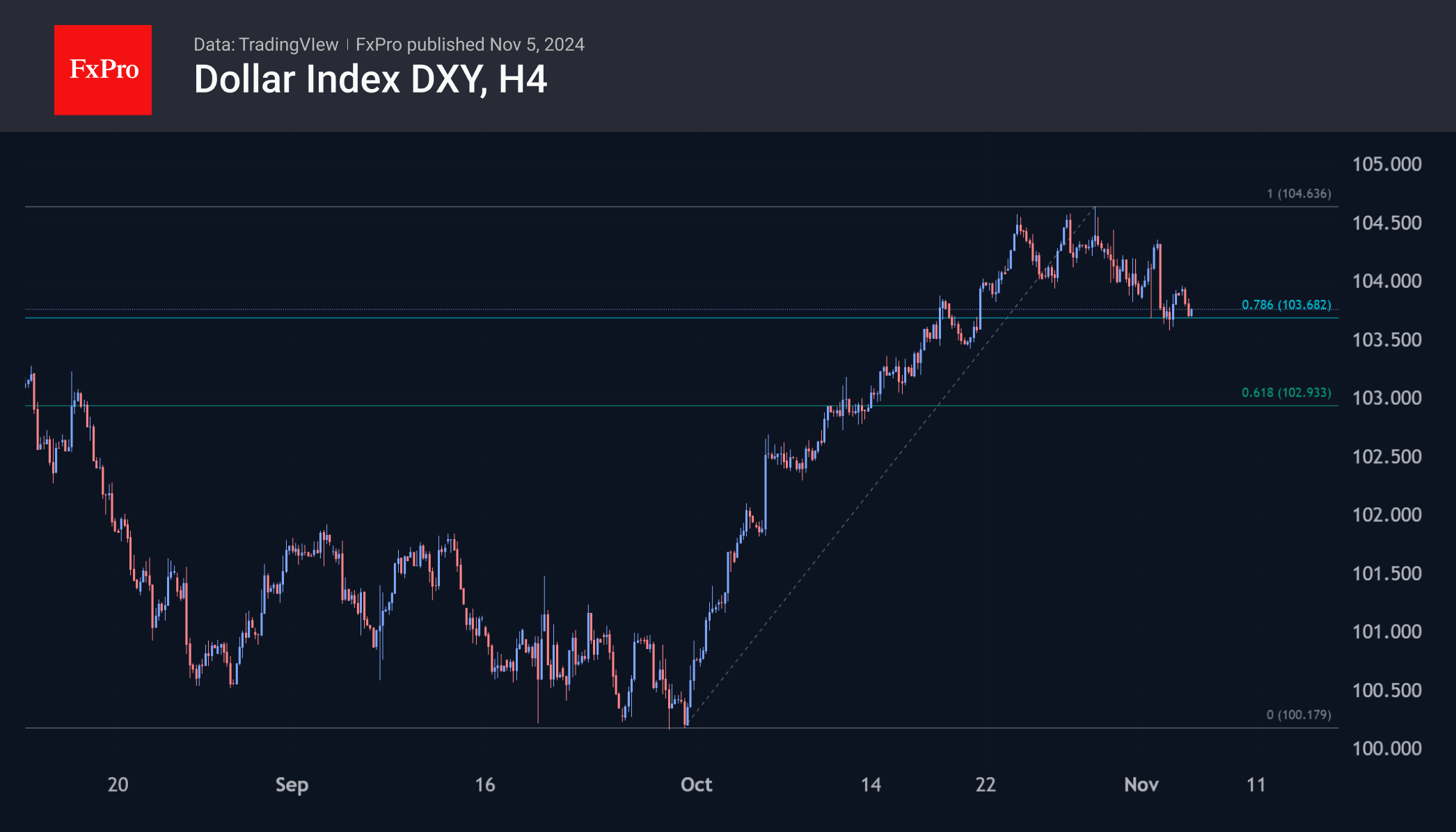

The dollar index is in a starting position and ready to start another move. October was the best month for the DXY in almost two years, but it has pulled back from local extremes in recent days, reaching the first retracement line at 78.6% of the last rally. This pullback is consolidating liquidity, which could come into play when the trend is determined.

For the past 12 years, the market has been whipsawed from one side to the other on the count day, and sometimes, the strength of the momentum has only increased. The calm comes after the winner has been determined and crystallised with their victory speech.

In terms of technical analysis for the Dollar Index, the prudent strategy is to enter the trend once it is confirmed. A drop in the Dollar Index below 103 would signal that the markets have moved beyond the corrective pullback. In this case, the chances of a fresh test of the lower boundary of the two-year trading range at 100 are high. A break below this line would kick off a decline to 90.

In the event of a sharp reversal to the upside, the area of the October highs, just above 104.5, is the control point. This will trigger a Fibonacci expansion pattern with a potential target at 107.4, which is also close to the 2023 highs. The dollar may not stop there, targeting the 2022 high at 114.7.

The FxPro Analyst Team