- The US labour market is sending mixed signals, and the Fed remains cautious.

- The Bank of Japan is moving at a snail’s pace, while the pound may surge.

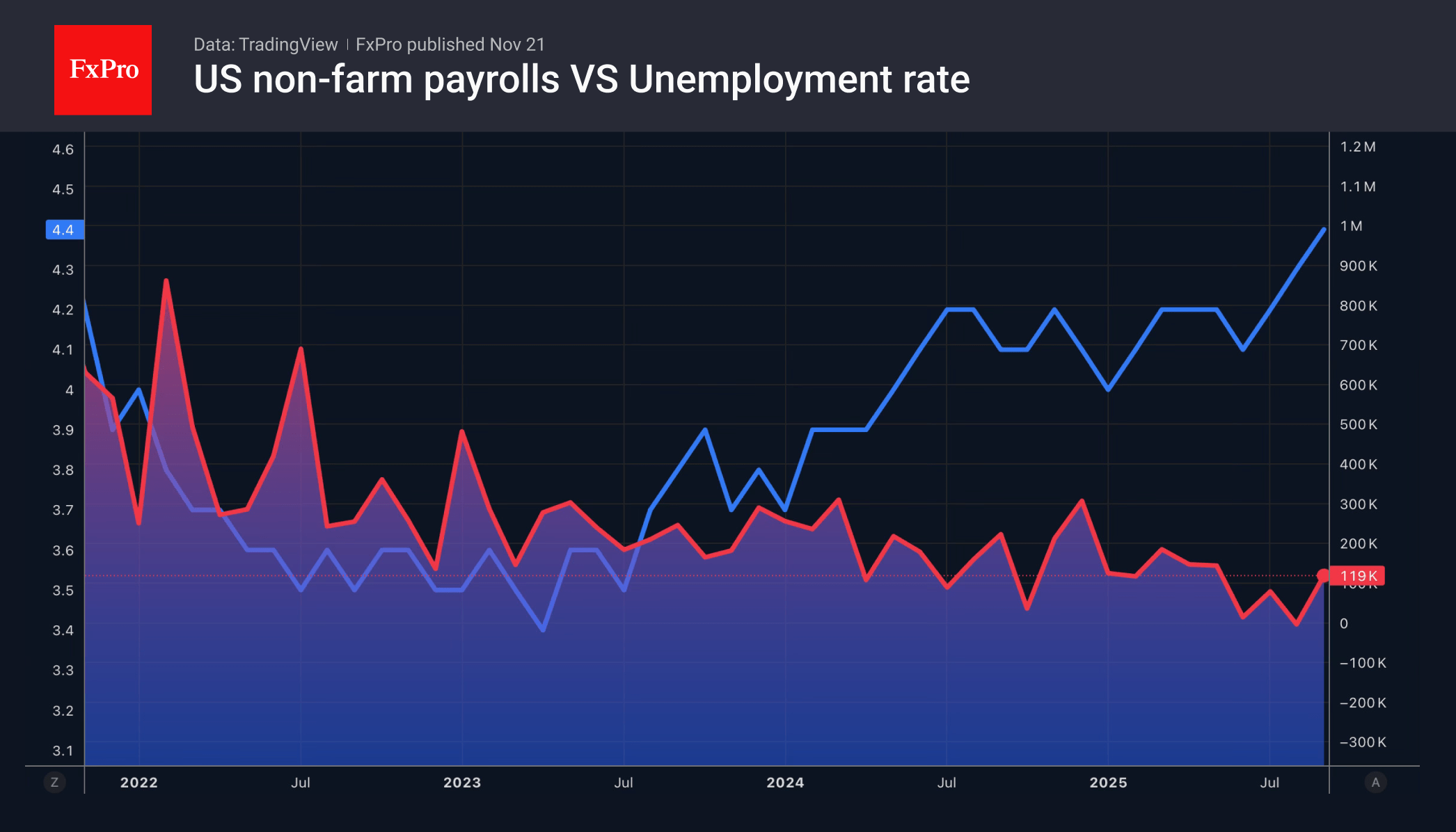

The US employment report slowed the dollar. After five days of growth, the DXY froze at its highest level since May. Investors considered the rise in unemployment to a four-year high of 4.4% to be a more significant factor than the acceleration of non-farm payrolls to 119,000. As a result, the chances of the Fed cutting rates in December rose from 28% to 33%, and in January from 65% to 70%. This allowed the EURUSD to find its footing.

FOMC officials continue to talk about caution. Chicago Fed President Austan Goolsbee is concerned that inflation is accelerating rather than slowing down. Cleveland Fed President Beth M. Hammack believes that easing monetary policy to support the labour market will prolong the period of prices above target. Her colleague from Philadelphia, Anna Paulson, warns that every rate change could trigger an acceleration in CPI.

Most likely, the Fed has outlined a scenario of maintaining borrowing costs in December, followed by a reduction in January. Data is needed to change this, and there is a catastrophic lack of it. Under such conditions, the US dollar is likely to remain stable or even strengthen in the short term.

The greenback’s competitors are not shining. The acceleration of consumer prices in October from 2.9% to 3% and inflation remaining above the 2% target for 43 consecutive months does not impress the Bank of Japan. Amid political pressure from the government, it intends to normalise monetary policy at a snail’s pace. As a result, the yield spread between US and Japanese bonds will remain wide. This allows carry traders to sell the yen as a funding currency, causing the USDJPY to rise.

The pound has seen glimmers of light through the clouds. There are rumours that Labour will not raise income tax due to improved economic forecasts for the UK. GBPUSD quotes could surge significantly if Rachel Reeves’ draft budget does not disappoint but instead pleases investors. In this case, the principle of ‘buy the rumour, sell the fact’ will work for the pound growth.

The FxPro Analyst Team