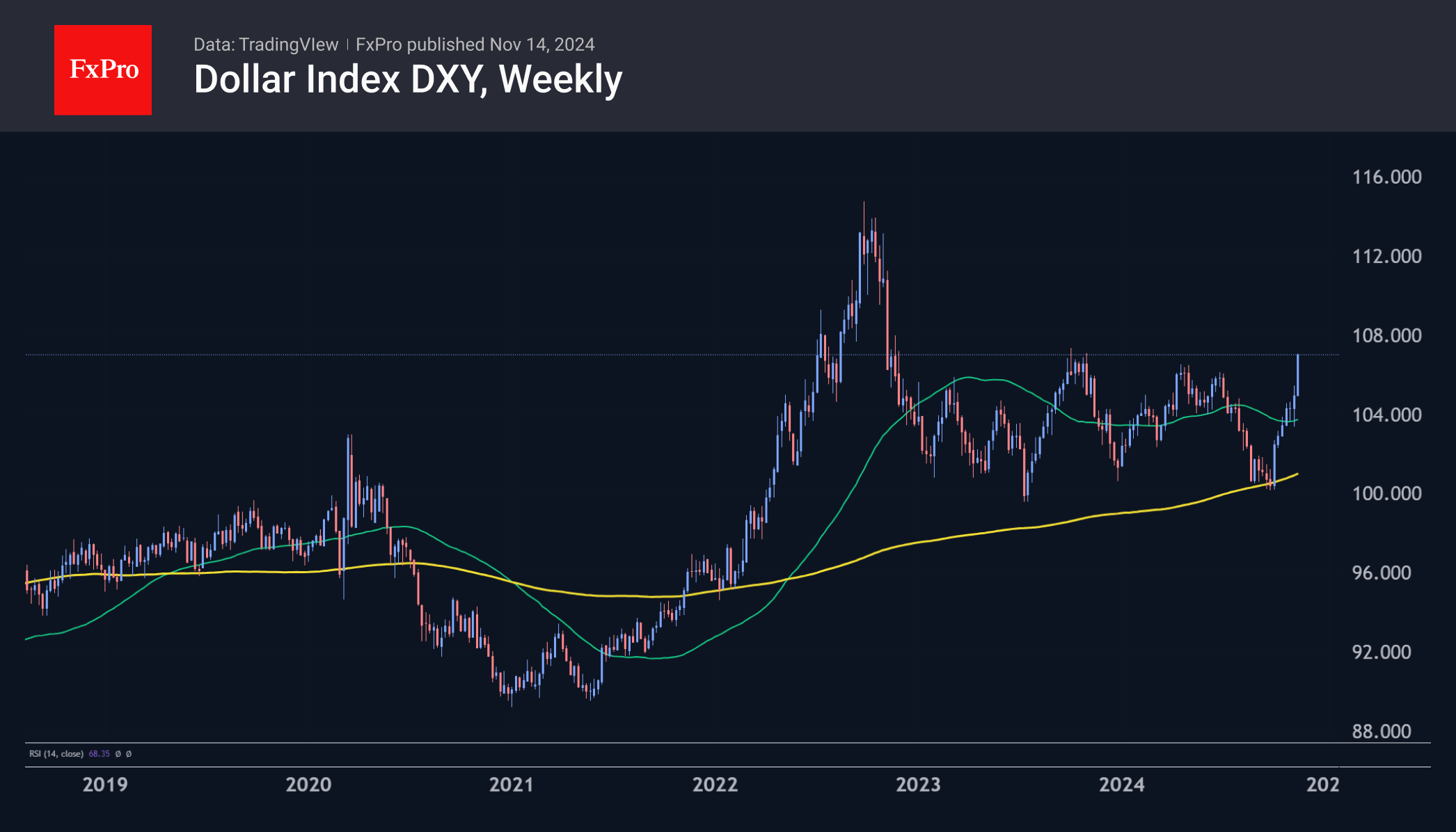

The US dollar continues to strengthen. Since the beginning of the week, the Dollar Index has gained just over 1.5%. However, the momentum behind this move deserves attention. From the lows at the end of September, the Dollar Index has risen almost 7%, taking it straight from the bottom of the trading range of the last two years to the top. Now, all eyes are on whether the bullish move will continue at the key resistance level of the last two years. The next move will be decisive.

The main driver of the dollar rally has been the dramatic change in the US political landscape, first anticipated and then confirmed in early November. Expectations of higher tariffs on US imports are strengthening the dollar, as is speculation about tax cuts and deregulation. At the same time, the latter is supporting equity indices, although they are finding it increasingly difficult to rise in an environment of a strengthening local currency.

The British Pound fell below 1.2700, hitting lows not seen since early August. In the process, it fell below its 200-day moving average. More importantly, it fell below the 50- and 200-week moving averages. Over the past 10 years, there have been six dips below this curve with an average momentum decline of 14%. On the technical side, the path to 1.2000 is now open despite the accumulated oversold condition. Whether the Pound will go all the way depends on the balance of power in the UK and US economies and the actions of the central banks.

In the short term, there is little hope for the Pound against a backdrop of rising unemployment and slowing wage growth. In both cases, we are talking about normalisation, not collapse. It will, however, allow the Bank of England to accelerate interest rate cuts.

The single currency has been actively sold off since the US election, as expectations of new tariff wars coincided with the collapse of the German coalition and floods in Spain, not to mention ongoing concerns about the region’s industrial sector. As a result, EURUSD has touched 1.05. This is the lower boundary of the trading range since the beginning of the year.

Historically, the 1.05 area has been a turning point for EURUSD. A failure below this level paved the way for a rapid decline below parity. In 2022, the decline stopped at 0.95. In 2000, the collapse of the then-new single currency was halted by ECB intervention on dips below 0.85.

The FxPro Analyst Team