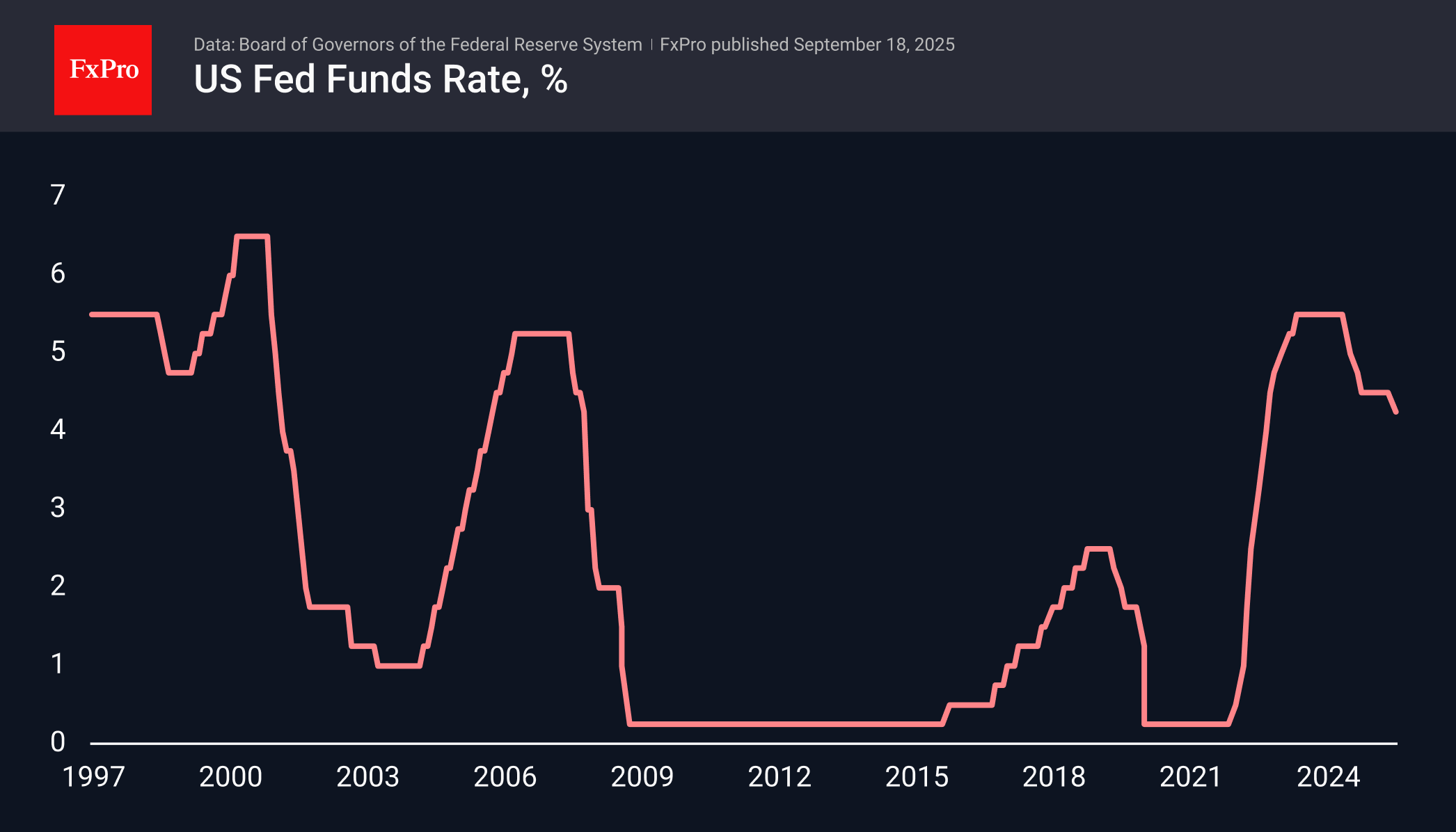

The Federal Reserve lowered the federal funds rate by 25 basis points to 4.00–4.25%, as predicted by the markets. Published forecasts showed that the Fed is set to ease policy in October and December as well. This was also the main scenario priced into the quotes, but the reduction in uncertainty supported risk appetite for stocks.

The scenario of three consecutive 25-basis-point cuts (including yesterday’s) is gaining momentum. The chances of a cut in January are now more obvious at 42%, compared to 14% a month ago. Expectations of lower rates were an important driver of the 7% growth in the Nasdaq100 and 5% in the S&P500 during this period.

However, it took some time for the markets to digest the information from Powell and co, as options for more aggressive policy easing were ruled out at the same time, even though Stephen Miran, a recent appointee of the Trump administration, voted for a 50-point cut.

At the same time, the reaction of the currency and commodity markets showed that the outlook for the dollar was not so bad. After the rate decision was announced, the DXY fell to its lowest level since July 1, triggered by high-frequency trading. This was also the lowest point since early 2022. At this level, the dollar is once again finding strong support.

Dollar bulls have stopped the start of a new global wave of decline. Technically, this pattern would have been triggered by an update of the July lows, marking the end of the corrective rebound. The potential technical target here would be a decline in the DXY to 88, which is close to the cyclical lows of 2018 and 2021. The dollar has not traded consistently below this level since 2014.

Dollar bulls are trying to avoid this disaster by defending important support. In our view, this battle in the coming days promises to have the greatest impact on global markets, becoming the basis for the formation of a long-term trend.

The dollar may be helped by both a softening of tone following the Fed in other parts of the world and an increase in US trade deals, which will bring capital back to America after many months of avoiding the dollar and government bonds.

The FxPro Analyst Team