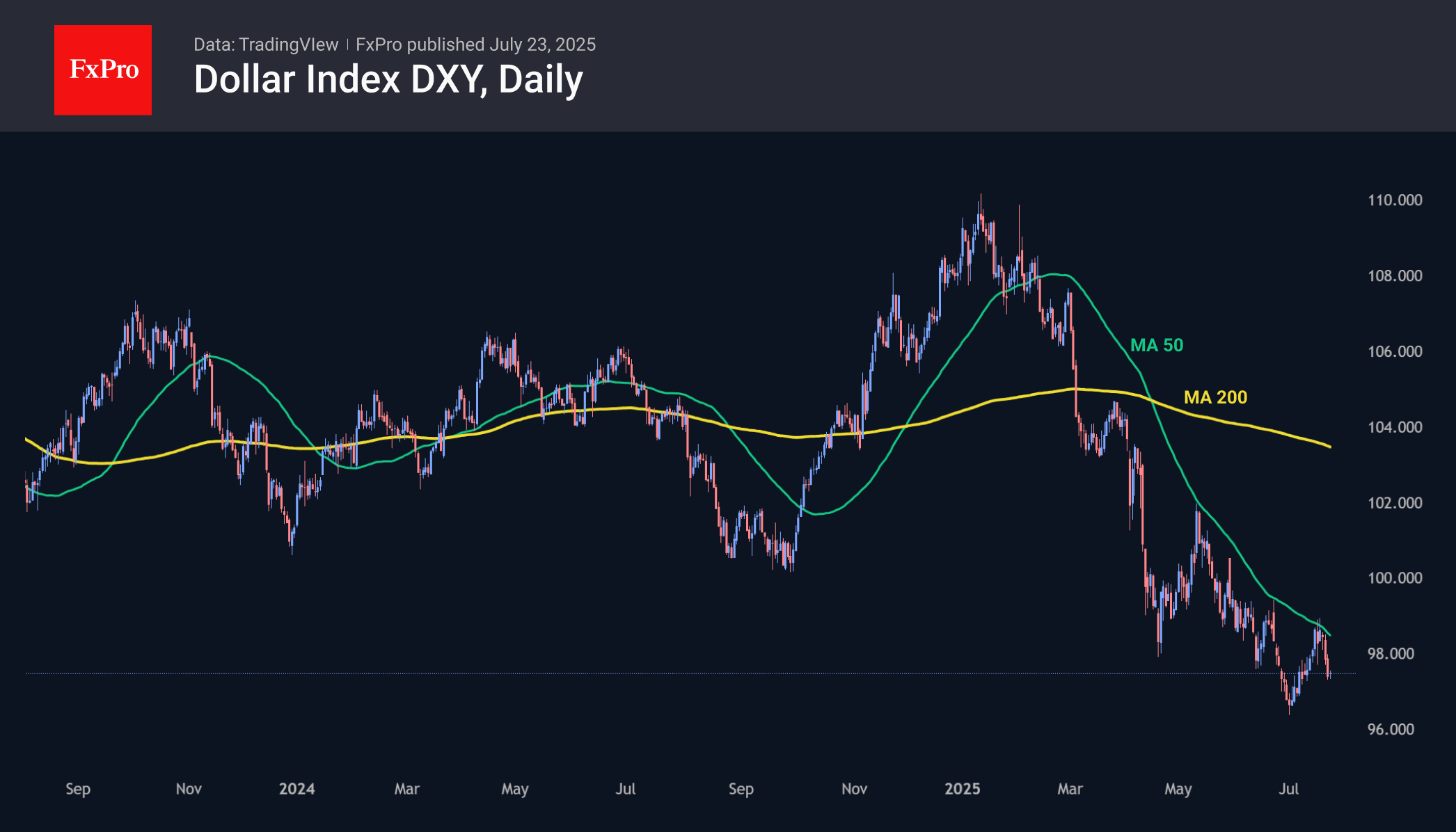

The dollar index has been under pressure since the end of last week, falling back to 97.2 after failing to consolidate above the 50-day moving average and break through the turning point at the end of June, just below 99.0.

The dollar started July by hitting new lows for over three years and accumulating significant oversold conditions. At the same time, the intensity of the decline slowed, encouraging bulls in their attempt to reverse the trend. Success was very limited, as there was not enough strength even to overcome the short-term downtrend, the upper limit of which was formed by the 50-day moving average.

On weekly timeframes, which reflect long-term trends, a strong bearish ‘death cross’ signal is forming, as the 50-week average falls below the 200-week average. In 2003, after this signal, the dollar remained in decline for another five years. However, the subsequent four similar crosses were close to cyclical lows.

The same is indicated by the dynamics of the relative strength index, which returned from the oversold zone (<30) in early July, remaining at 35 despite the weakening of the DXY.

Fundamental factors may also shift in favour of the dollar. In 2018, the dollar began to rise after the initial shocks of Trump’s victory and the tariff wars he announced a year later, as they worked to reduce the international trade deficit. In both 2018 and 2025, inflationary risks are forcing the Fed to keep rates higher than they could be, which also works in favour of the dollar.

The FxPro Analyst Team