- The US government shutdown is over.

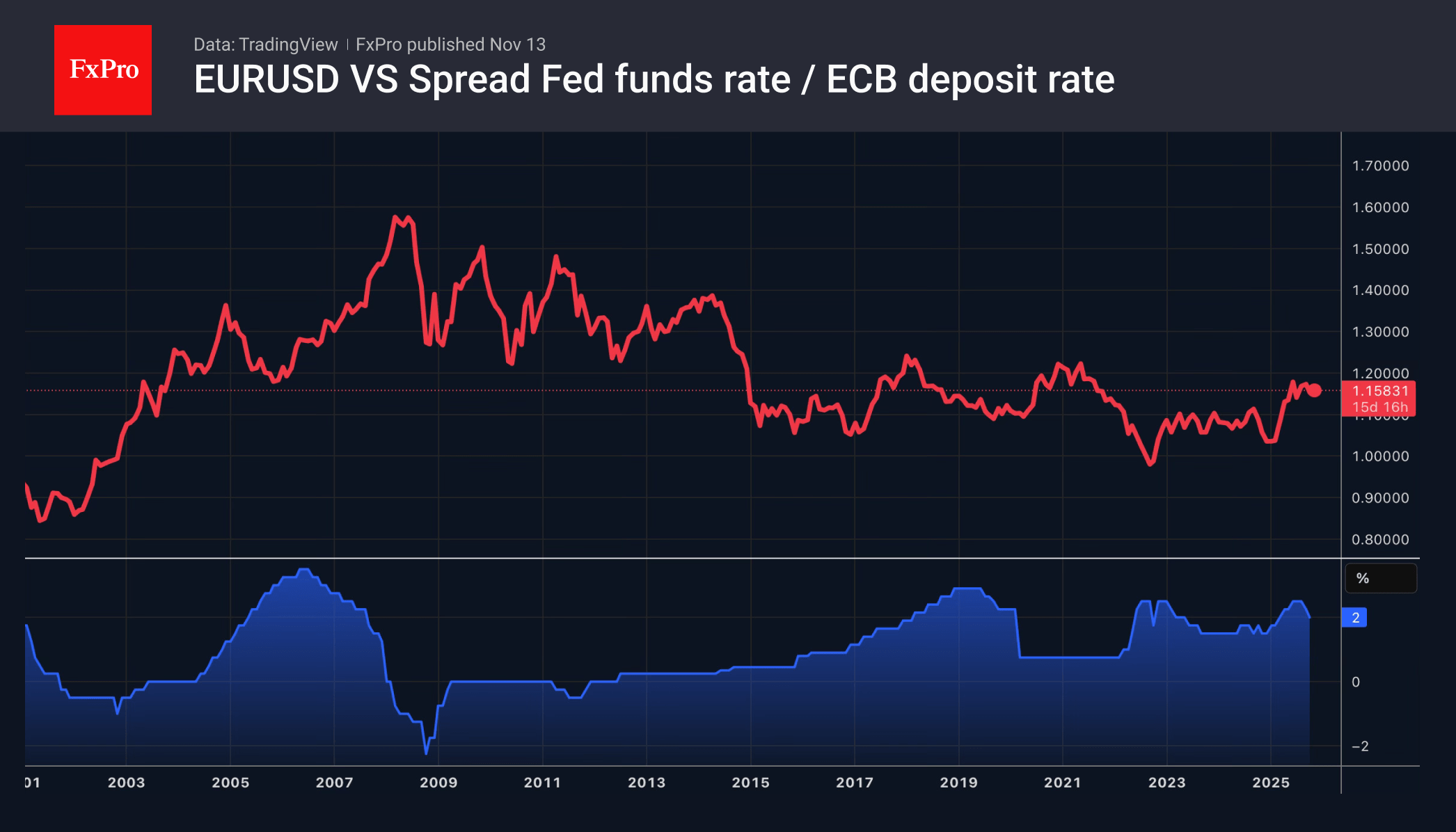

- Central bank policy convergence helps EURUSD.

- Political scandal causes the pound to fall.

- Japan’s currency interventions are ineffective

The House of Representatives voted 222 to 209 to resume government operations. The president immediately signed the document. The record-long shutdown is over. This fact promises that the Fed and investors will soon begin to exit their positions. The president immediately signed the document. The record-breaking shutdown is over. This fact suggests that the Fed and investors will quickly start to emerge from the fog once statistics are published again, allowing them to make data-driven decisions. But will they like what they see when the picture becomes clearer?

Alternative sources show a slowdown in the US GDP. The IMF forecasts a decline in its growth rate from 2.8% to 2% in 2025. The eurozone, on the other hand, is expected to accelerate from 0.9% to 1.2%. At the same time, the Bank of France plans to raise its estimates for the country, despite the ongoing political turmoil. The narrowing divergence in economic growth argues in favour of maintaining the upward trend for EURUSD.

The same can be said about monetary policy. The ECB has most likely ended its easing cycle, barring any major shocks. The federal funds rate is likely to continue falling amid a cooling US labour market and economy. The euro has advantages over the dollar. However, in the short term, mixed data could lead to mixed movements in EURUSD.

The conflict on Downing Street has allowed GBPUSD bears to launch a new attack. When Labour came to power in Britain in 2024, the pound gained preference thanks to hopes for political stability after constant ministerial changes under the Conservatives. However, since then, Prime Minister Keir Starmer’s ratings have been falling. Rumours of a plot to replace the leader have made investors nervous and prompted them to sell sterling.

Doubts about the effectiveness of potential currency interventions continue to push the USDJPY pair higher. The current conditions differ from those of last year. Back then, Tokyo intervened in the FOREX market before raising the overnight rate. Now, Sanae Takaichi is sticking to a policy of fiscal and monetary stimulus. Any purchase of the yen will only have short-term success. In addition, it will require the expenditure of foreign exchange reserves. These are needed to make the investments in the US economy promised to Donald Trump.

The FxPro Analyst Team