- US GDP growth is driven not by the White House, but by AI.

- The Bank of Japan’s sluggishness is weighing on the yen.

JP Morgan believes that the White House’s focus on lowering interest rates will have the opposite effect. Inflation will accelerate, and rates will rise. Donald Trump claims that Jamie Dimon is wrong and just wants rates to be high so that his bank can earn more. He went on to describe Federal Reserve Chair Jerome Powell as a “bad person” who, in his view, is hindering the prosperity of the American economy.

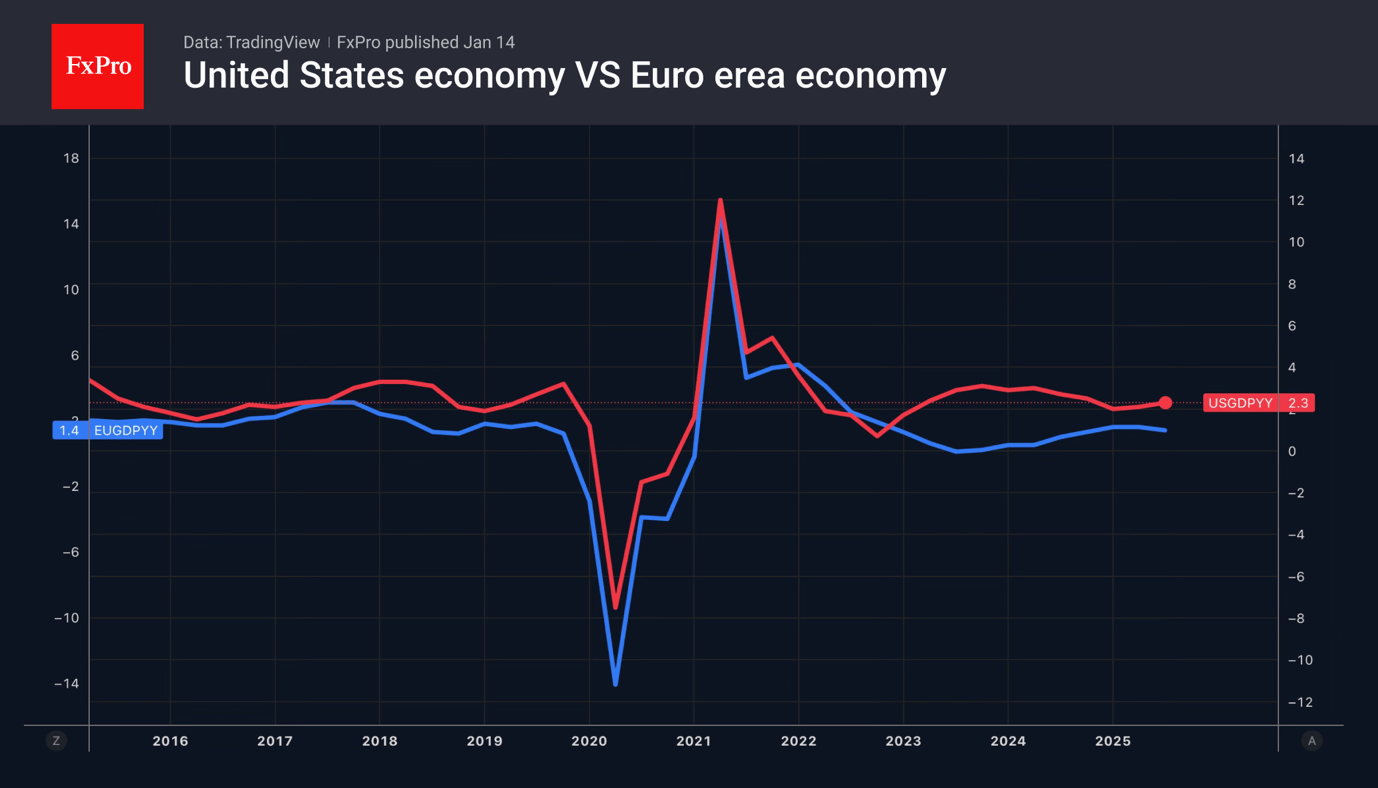

The US economy is indeed pleasantly surprising. The World Bank has pointed to its resilience to tariffs and raised its GDP forecast for 2025 from 1.4% to 2.1% and for 2026 from 1.6% to 2.2%. The growth in these indicators is not based on White House policy, but on large-scale investments in artificial intelligence technology. However, Donald Trump has his own opinion on this matter. According to the president, in 11 months, the American administration has achieved explosive growth in the economy and productivity, victory over inflation, and prosperity in investment. Is more to come?

However, we have to adjust the midterm election promotions. Inflation in the US may have fallen to 2.6-2.7%, but it is still significantly above the 2% target. GDP growth is impressive, but the cooling labour market is causing the Fed to cut the rate from 4.5% to 3.75% in 2025. Currently, FOMC officials believe that monetary policy is well-positioned. They intend to maintain a pause in the cycle, which supports the dollar.

Meanwhile, the yen continues to get battered. Investors expect Sanae Takaichi to dissolve parliament and call new elections as early as February. This is leading to higher Japanese bond yields and a surge in USDJPY to 18-month highs, returning to the previous territory of currency intervention. The stronger the Liberal Democratic Party’s footing, the more chances of higher fiscal stimulus. At the same time, the government may put pressure on the central bank to prevent interest rates from rising, as this increases the cost of servicing the national debt.

In this regard, Kazuo Ueda’s speech on continuing the cycle of monetary policy normalisation while meeting the conditions required by the Bank of Japan can be seen as justifiable. Investors do not expect an overnight rate hike before June, which, against the backdrop of a prolonged pause by the Fed, allows USDJPY to rise.

The FxPro Analyst Team