- The Fed is leaning towards not cutting rates in December.

- The pound and yen are under pressure due to government actions.

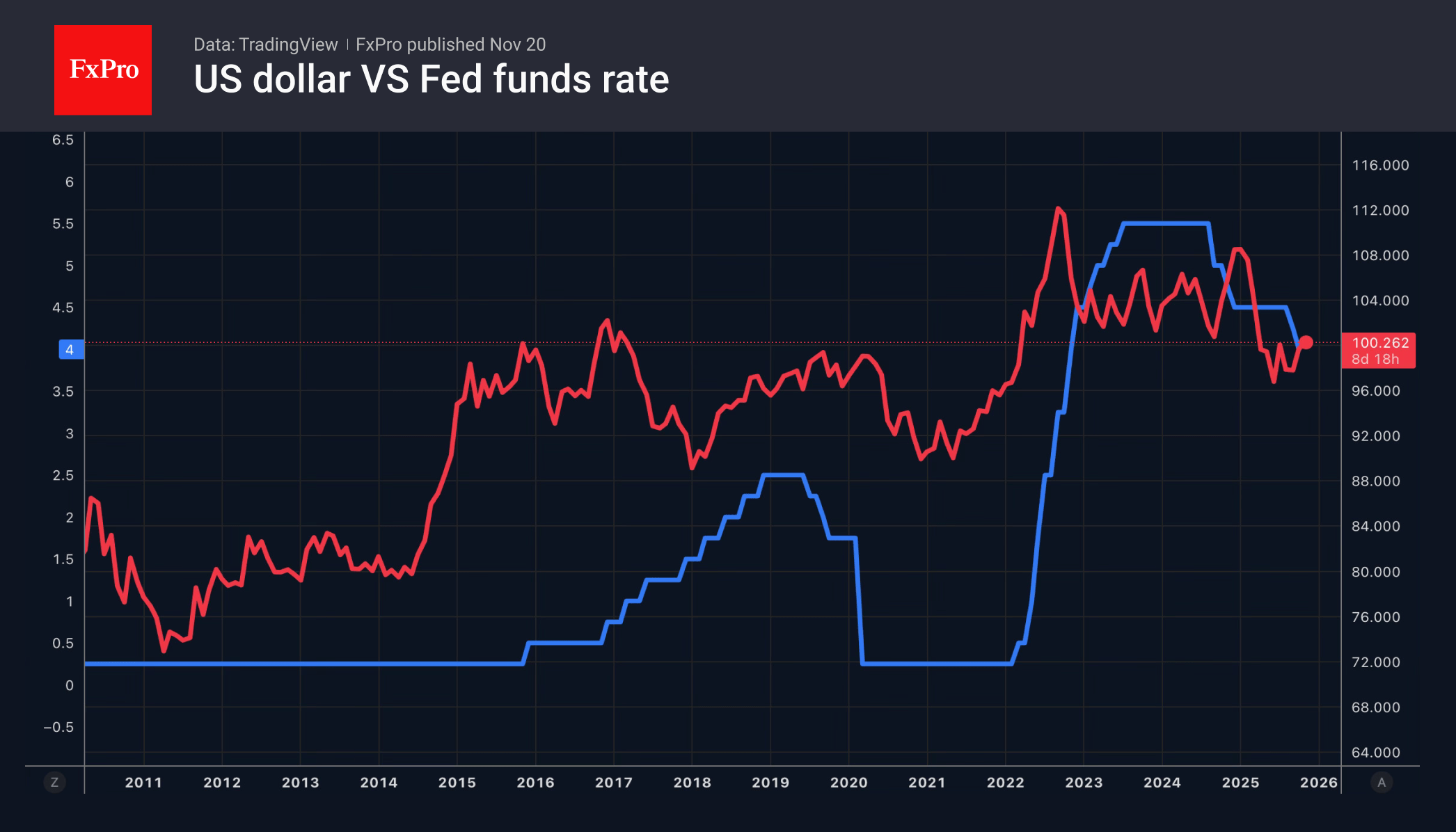

The US dollar spread its wings thanks to the hawkish rhetoric of the minutes of the October FOMC meeting. Most officials considered it inappropriate to cut the federal funds rate in December. The chances of such an outcome fell to 1 in 3. As a result, the dollar index returned to its six-month highs. Quotes were also supported by statements from the Bureau of Labour Statistics, which will not publish the October report separately but will include the available data in the November report, due out on December 16, after the Fed meeting on December 10. The lack of data will certainly incline the Fed to take a wait-and-see approach.

Unhappy with the Fed’s unwillingness to ease monetary policy, Donald Trump said he would like to fire Jerome Powell, even if the Treasury Secretary advises him not to do so.

The White House’s pressure on the central bank was one of the drivers behind the 10% fall in the USD index in the first half of the year. Donald Trump then eased his grip as the Fed cut rates in September and October. The Fed’s shift to a wait-and-see position has put pressure back on Trump’s agenda, which translates into pressure on the dollar.

However, the USD index remains in the spotlight, partly due to the weakness of its main competitors. The slowdown in British inflation in October, from 3.8% to 3.6%, increased the chances of the Bank of England cutting its key rate in December to 0.8%. Divergence in monetary policy pushed GBPUSD below 1.31 for the second time this month, to its lowest level since April.

Pressure on the pound is mounting as the draft budget announcement on November 26th approaches. Fears of tax increases are driving up the cost of hedging against a collapse of the pound against the euro and the franc to 4- and 6-month highs, respectively.

The yen is not faring any better. USDJPY has soared to 10-month highs despite increased verbal intervention. Investors believe that the government is doing this for show. The rhetoric of Sanae Takaichi’s economic advisers suggests that the BoJ will not raise rates until March.

The FxPro Analyst Team