Market Overview

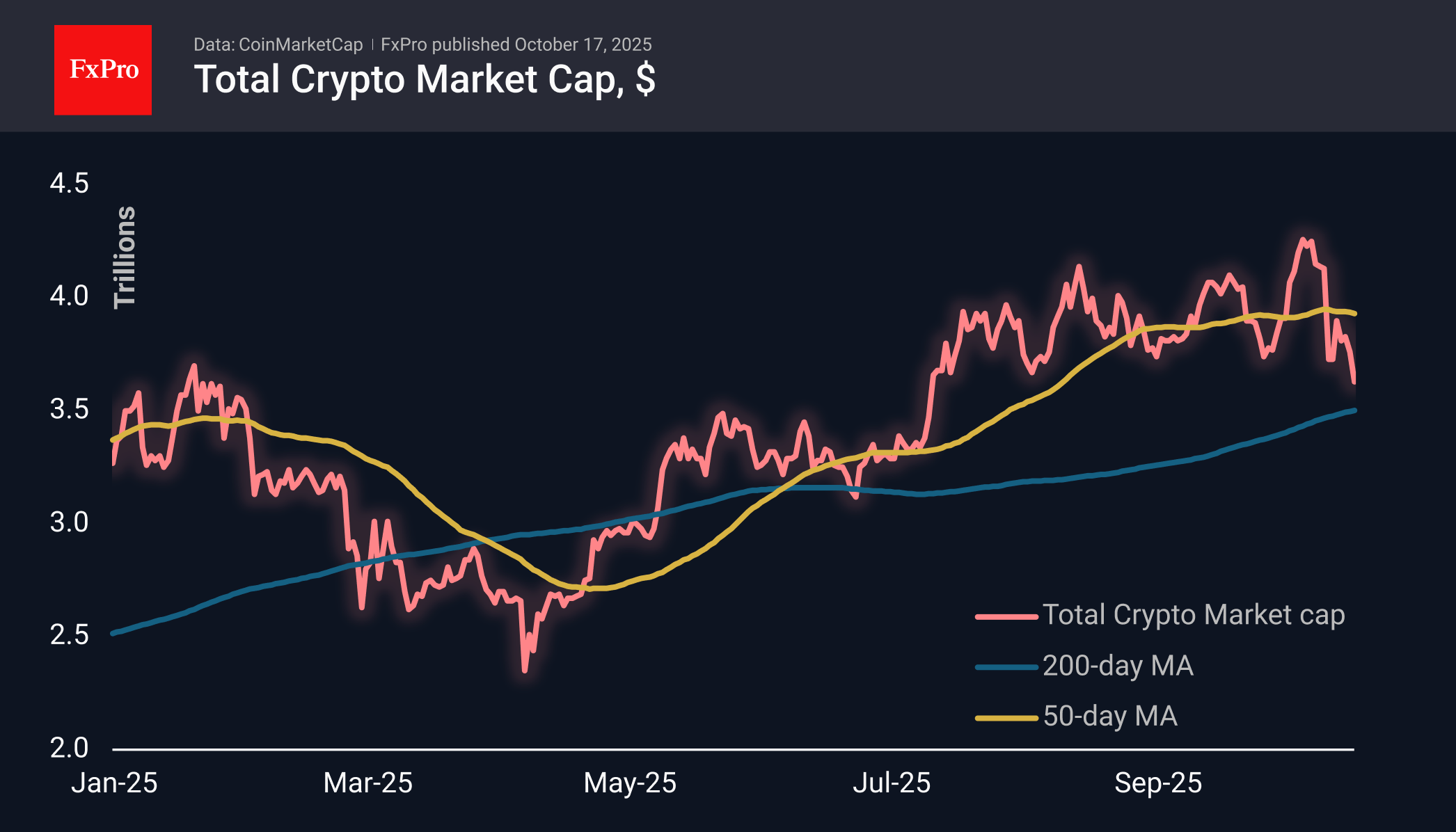

The crypto market resumed its decline on Friday, falling 5% in 24 hours to $3.57 trillion. This time, it looks more like a painful reflex after the events of a week ago. But this is an even more dangerous dynamic because we are not seeing a slip in a thin market, but rather a massive sell-off in search of a new bottom. We will closely monitor market dynamics at the 200-day moving average of $3.50 trillion, where there could be a sharp rebound at the end of June or a further decline in March.

Bitcoin fell below $106K. The last time the price consistently exceeded current levels was in early July. The first cryptocurrency plunged below the 200-day moving average. Over the past couple of years, fixing below it triggered a sideways movement for several weeks before the market was able to find solid ground.

News Background

Since October 9, miners have transferred 51,000 BTC worth more than $5.7 billion to Binance, according to CryptoQuant. This may indicate a change in strategy — from holding assets to selling or hedging them.

Large Bitcoin holders are reducing their positions without signs of panic, selling about 17,500 BTC in recent days, according to BRN. However, since the beginning of the year, they have remained net buyers, accumulating more than 318,000 BTC.

Retail investors have increased their purchases of Bitcoin after the recent market correction. At the same time, large investors are reducing their sales volumes, according to Glassnode.

CoinGecko recorded a decline in the correlation between Bitcoin and the S&P 500 index from 0.9 to zero in the third quarter. At the same time, other cryptocurrencies remained moderately highly dependent on the stock index — 0.68 versus 0.88 previously. The correlation between Bitcoin and the overall crypto market has also weakened.

Ethereum has overtaken Solana and Bitcoin regarding the number of new developers. Since the beginning of the year, the number of developers in the ETH ecosystem has grown by 16,181.

According to the Financial Times, President Trump’s family has earned over $1 billion from cryptocurrency projects. The politician’s son, Eric Trump, confirmed to the publication that the actual profit is “most likely much higher.”

The FxPro Analyst Team