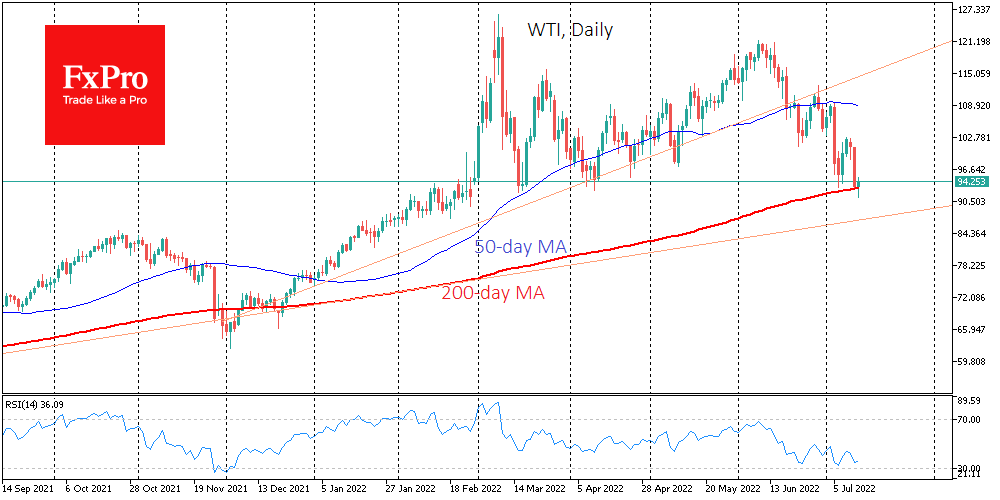

Oil lost more than 10% in just over 24 hours, starting to decline late in the day on Monday. WTI crude fell to $91.30 as it sold off. Having lied on the way down stop orders, oil at one point fell below the 200-day moving average.

Oil has not traded consistently below this level since November 2020, throughout the last bull market. Notably, Biden’s election victory was the start of a rally across a wide range of risk assets from the Nasdaq100 and crypto to oil and other commodities. However, equities and cryptocurrencies have already zeroed in on that rise, while black gold is now around 150% more expensive than it was at the start of the active upcycle.

However, we remain of the opinion that the tide in oil has already turned. Since June 9, i.e. for more than a month, we have seen a downtrend in oil prices with a succession of lower local lows and higher highs.

During this time, the short-term, most violent bullish momentum has been reversed. At the same time, the speed of the fall is only gaining momentum. In July, two more than 10% declines have already occurred within 24 hours.

It looks like we only see the start of a decline in oil. Geopolitics, rapid demand after lockdowns and underinvestment in production have made the rally in oil sharper than in many other commodities. But now, we see consumption growth stagnating or even going down in some cases. Meanwhile, the leading producers (US, Saudi Arabia) are ramping up and promising to ramp up production soon.

All this leads us to believe that the commodity super-cycle did not take place and turned out to be sharp, but not for long. And the road ahead for oil is downhill. The closest meaningful stop on that downward path for energy prices looks to be $83 for WTI and $85 for Brent.

The FxPro Analyst Team