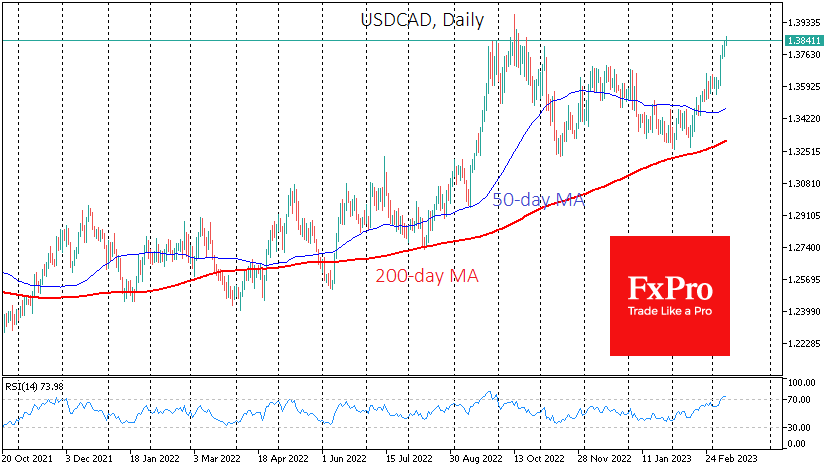

USDCAD has been rallying this week, gaining 1.7% since Tuesday and testing the five-month high of 1.3850. The pair looks vulnerable to both a short-term correction and the potential for a longer-term reversal.

The US Dollar has enjoyed gains after Powell’s hawkish rhetoric forced the markets to consider a 50-point rate hike on 22 March seriously. This is significant because the markets were pricing in 2-3 more 50-point hikes before that. And even earlier in the year, they were already pricing in a rate cut before the end of the year.

Almost simultaneously, the Bank of Canada avoided surprises by leaving its policy rate unchanged, as it had warned in its commentary on the January decision. This starkly contrasts the Fed’s stance, which changed after strong reports on employment and consumer spending inflation.

The only change the Bank of Canada decided to make was to warn at the end of the commentary on the decision that further hikes from the current 4.5% were possible. Canada’s reluctance is easy to understand as it has only been at the current rate since 2001, from July to October 2007, when it was cut to 0.25%.

The acceleration of rate hikes in the US and the pause after the slowdown in Canada is a major driver for the USD against the CAD. This difference promises to be unprecedented in modern history, with the G7 central banks acting almost in sync and moving in the same direction.

The divergence may exist only in the minds of currency speculators, not central bankers. Powell’s speech contained the typical caveats used by the Fed since Greenspan, leaving the door open for future action. The actual actions of the US and Canadian central banks have been at least in the same direction, if not identical.

The USDCAD has reached overbought territory in the currency market on the daily RSI. The exchange rate has now reached levels where selling intensified in October and November last year. The pair have not traded consistently above 1.40 in the past 20 years. Short rallies have only been associated with periods of extreme market volatility and plunging oil prices, which is not the case here.

A pullback from current levels means the pair could slide as low as 1.36, completely erasing the latest growth impulse. However, it is unlikely that the pair will stop there, as it will be a move from the top of the multi-year trading range to its bottom around 1.20–1.25.

The FxPro Analyst Team