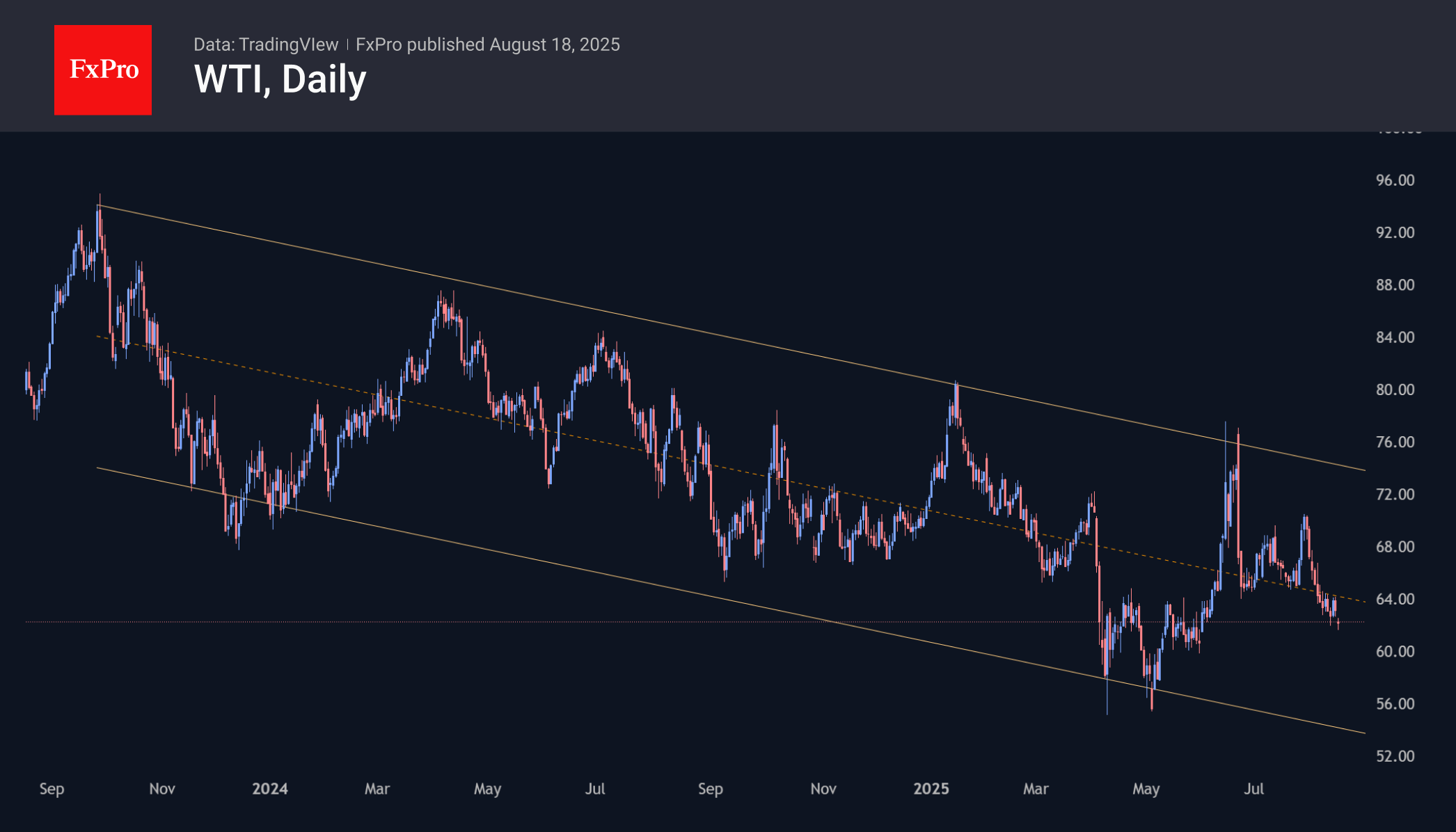

There are signs that oil prices are attempting to bottom out at around $61 per barrel for WTI and $65 per barrel for Brent. In the middle of last week and at the start of trading on Monday, local lows were touched, last seen in early June. However, the local rebound does not look convincing, indicating instead a pause in the decline within the downward movement inside a two-year descending channel.

Fundamental data from the US also remained largely unchanged. The number of oil rigs rose to 412, compared to 411 and 410 in the last couple of weeks.

Commercial stocks remain close to year-ago levels and close to the average for the last 12 weeks. Average daily production levels are close to 13.3 million barrels per day. The US first reached these levels at the end of 2023, after which we saw a plateau in production, fluctuating between 13.6 and 13.2 million.

At the same time, oil is becoming more abundant due to the restoration of OPEC+ supplies. The latest announcement of plans for September returns quotas to pre-November 2023 ‘voluntary reduction’ levels. OPEC+ refers to an oil deficit in its calculations, while the IEA notes the fifth month of inventory growth in July. This process is likely to gain momentum from September onwards, unless there is an acceleration in global economic growth.

Meanwhile, natural gas production in the US is setting records and contributing to the energy surplus.

The difficult situation for oil is also indicated by the reluctance of this commodity to respond to the growth in risk appetite in recent weeks, when hopes for monetary policy easing pushed markets to historic highs.

In such conditions, it is reasonable to expect oil prices to continue drifting downward, with the potential to renew the lows of early May — $55 for WTI and $58 for Brent — before the end of September. In the fourth quarter of this year, the price may well test the lower boundary of the downward channel, setting these lows another $5 below those of May.

The FxPro Analyst Team