The British pound fell below $1.35, confirming the downward trend since the beginning of the month. However, in recent days, this profit-taking after growth has been accompanied by the possibility of a deeper dive.

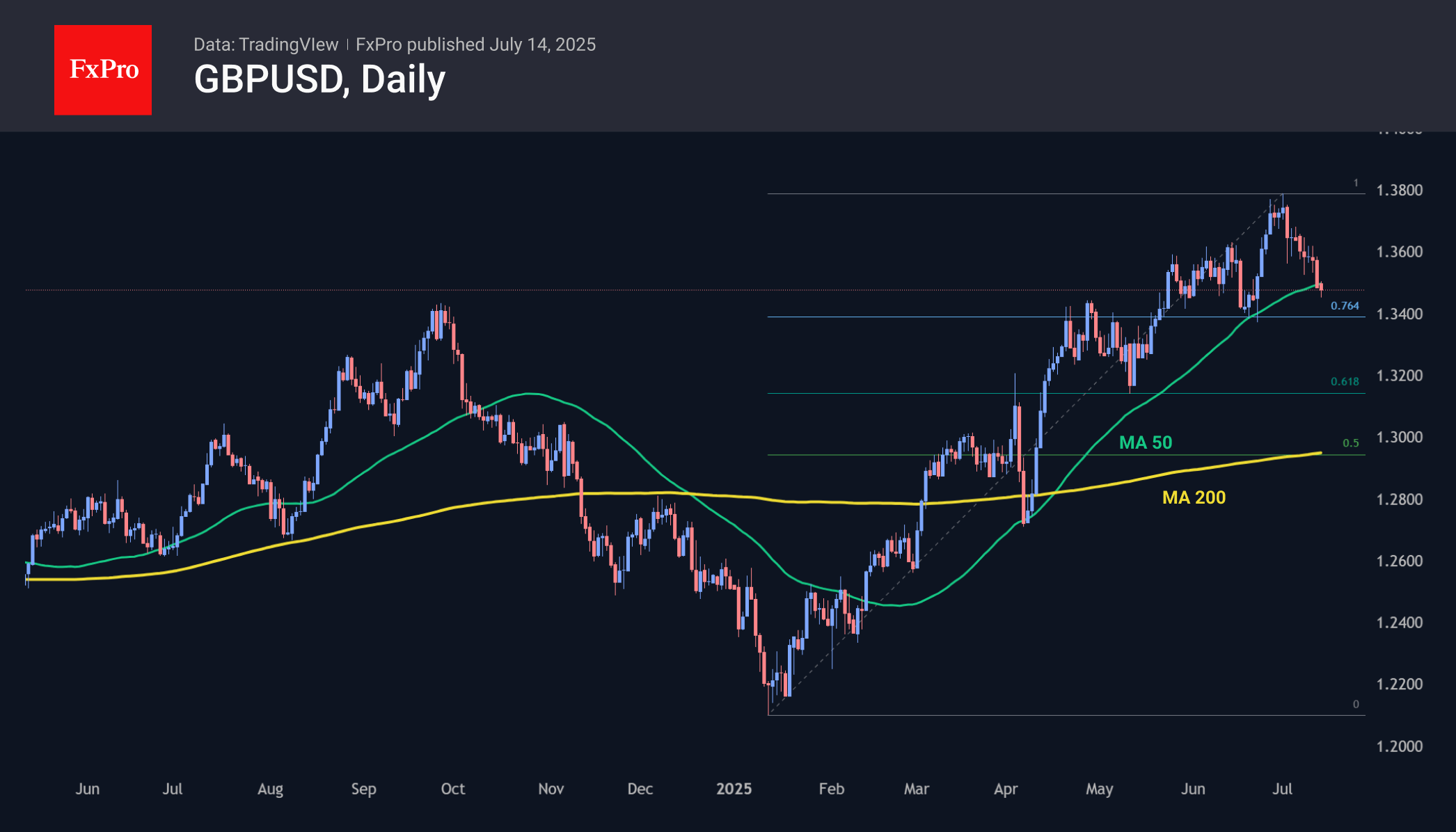

The upward trend in GBPUSD since the beginning of the year has formed a trend of higher local lows and higher highs. In April, May and June, touching the 50-day moving average spurred buyers, stopping the local retreat.

However, the new week begins with a dip below the 50-day moving average and below the round level of 1.35. Moreover, at current levels, the price is only 100 points above the previous local low, threatening to break the upward trend.

The fundamental background has also been working against the British currency recently, with the chances of the Bank of England moving further towards a more dovish position increasing. This implies lower interest rates than previously assumed by the markets. The main factor behind this revision is tariffs, which are weighing on business activity in the UK. In contrast, tariffs create inflationary risks, intensifying speculative pressure on the currency market.

The tariff wars of 2018 proved to be a bullish factor for the dollar despite its initial weakening. Even with the frightening sell-off of the dollar in the first half of the year, we may well see a repeat of this trend in the long term.

We see the levels of 1.3380, the area of previous local lows, and 1.3150, where support is at 61.8% of the growth amplitude from the January lows to the peak in early July, as potential targets for the beginning of the pullback.

The FxPro Analyst Team