The British pound is lagging today against most competitors. Pressure on sterling has increased following comments from Boris Johnson’s spokesman that Britain needs to know by 15th of October whether there will be a deal with the EU. The EU said that it is not planning any new concessions by this new deadline, betting that the UK is bluffing.

There is still plenty of time until 15th October, so the pressure may increase further in the coming days.

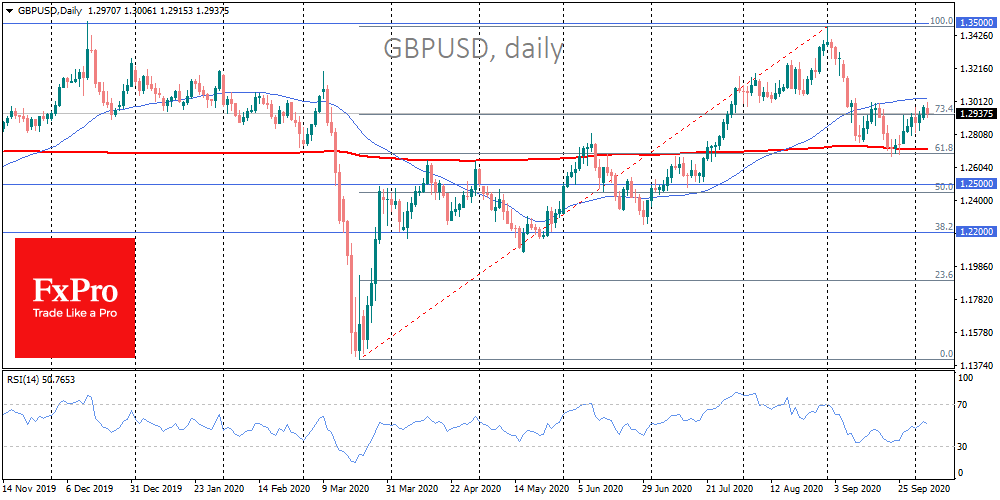

This could be bad news for GBPUSD, which has reversed downwards to a 50-day moving average and could quickly fall back to support near 1.2700, on the 200-day average. If things get more anxious, bull and bear battles could soon move to 1.2500 or lower at 1.2200.

The FxPro Analyst Team