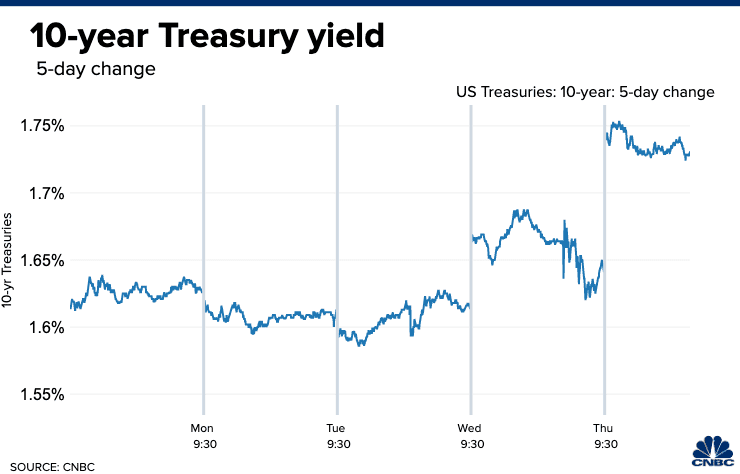

Treasury yields flared on Thursday as bond market players grappled with the Federal Reserve’s willingness to allow inflation to heat up. The 10-year Treasury yield shot up from 1.64% late Wednesday to 1.75% Thursday, a 14-month high. It was at 1.706% in afternoon trading. The rise in yields – which move opposite to price – comes a day after Fed Chairman Jerome Powell reassured the market that the central bank isn’t ready to dial back its bond purchases and other supportive measures.

While bond market pros say there was no development that kicked off the spike in yields on Thursday, the market’s focus seems to have turned to the fact that the Fed plans to let inflation run hot. The run-up in interest rates, for now, does not pose a risk for the economy. Strategists say the yield is still relatively low, particularly given the expectation for explosive economic growth this year.

However, the move in yields overnight was especially large, even given the recent increase in the 10-year yield, which was at 1.07% six weeks ago. The benchmark 10-year is widely watched, as it influences mortgage rates and other consumer and business loans. The bond market barely moved Wednesday afternoon, after the Fed issued its 2 p.m. ET statement and after Powell briefed the media.

Inflation is still low, with the core consumer price index, excluding food and energy, at annual rate of 1.3% in February. However, starting this month inflation levels could tick up due to the base effect from last year’s big decline in prices during the economic shutdown. The market has been challenging the Fed by pricing in rate hikes for 2023. Meanwhile, the central bank’s collective forecast, called the dot plot, shows no consensus for a rate hike through 2023.

The bond market rebels as it adjusts to the Federal Reserve’s inflation policy, CNBC, Mar 19