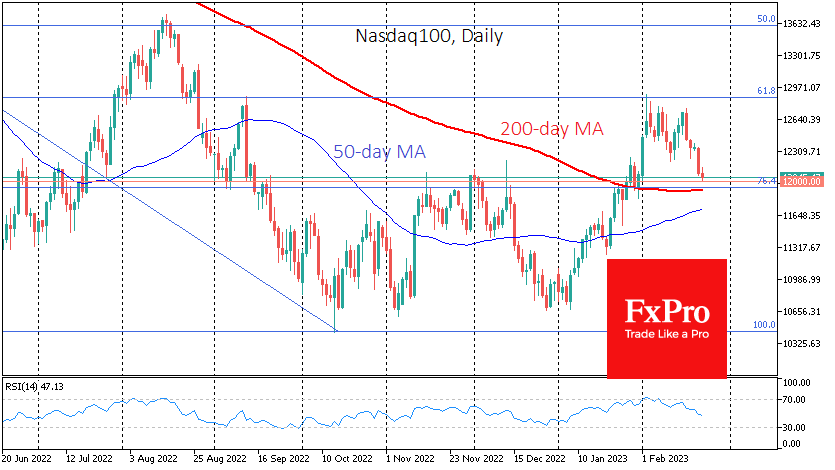

After losing more than 2.4% on Tuesday, the Nasdaq100 index has returned to the level from which it began February, near 12000. Apart from the nice round level, the 200-day moving average and local resistance from November and December are also concentrated here and may now have a chance to become local support. Furthermore, the pullback from 12900 represents a 61.8% retracement of the rally from the January lows to the early February highs.

To make matters worse, the rally since the beginning of the year has run out of steam approaching the 61.8% level of the decline from the November 2021 highs to the October 2022 lows.

This combination of key technical levels suggests we are in for a critical trend battle that could shape the market for weeks and months.

Much is now in the hands of politicians. They can either continue pushing the economy to cool inflation, or they can loosen their grip and opt for a wait-and-see approach, hoping enough has already been produced.

So far, there has been a striking divergence between the monetary authorities’ intentions and money market valuations and the stock market’s performance, which has behaved better than expected in such circumstances. As always, either the market knows something in advance or is overly optimistic and will be brutally disappointed in the coming days. The dynamics of the Nasdaq100 since the second half of last week suggest the latter scenario.

The FxPro Analyst Team