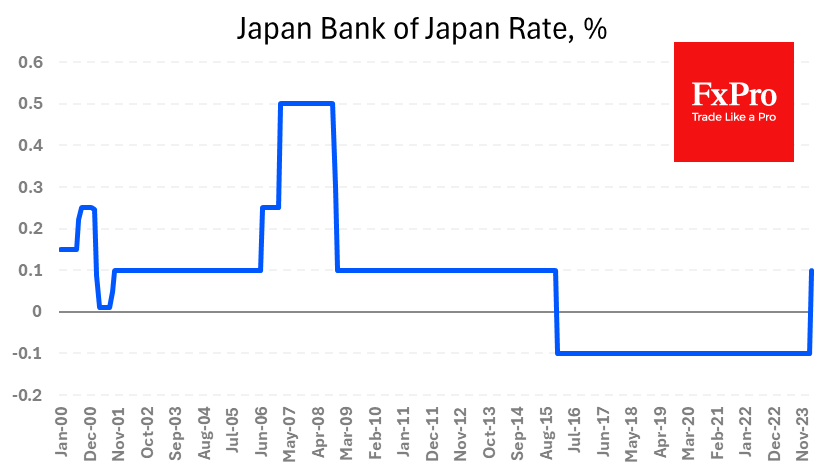

The Bank of Japan raised its key interest rate, becoming the last of the world’s central banks to abandon its negative interest rate policy.

The BoJ raised the rate from -0.1% to a range of 0.0% to 0.1%. The central bank will charge 0.1% on commercial banks’ balance sheets, the first time it has done so since 2016. The BoJ also declined to make further purchases of real estate ETFs and trusts and to control the yield curve. For now, however, the central bank will keep its purchases of government bonds “at roughly the same level”.

Ironically, Japan’s last rate hike cycle began in 2006, and the last (second) hike in February 2007 was six months before the Fed’s first cut. In other words, it was a belated move when the world’s central banks were already on the eve of a policy reversal. Now, the dissonance is even more striking, with the March hike in Japan coming some three months before the expected Fed cut.

The rationale for the hike was the most significant wage increase in more than three decades, as agreed with the unions, as well as inflation above the 2% target for the past 22 months.

It is interesting to note the reaction of the market, where the conviction for a hike, which has been building throughout last week, was accompanied by a weakening of the Yen. USDJPY’s rise of around 1% after the announcement, on top of a 2% rise from last week’s lows, can hardly be considered a buy-rumours-sell-facts reaction. At the current level of 150.50, it is trading close to the February highs, having erased almost all of the gains on rate hike speculation.

But the technical picture is very much in a simple pattern suggesting further upside. The decline from late February to the March lows has stalled near the 200-day moving average and near 61.8% of the rise from the late December lows to last month’s highs.

A USDJPY break above the previous highs near 151.0 would trigger a bullish scenario to 157.55 (161.8% of the initial advance). This level also coincides with the pair’s 1990 highs.

The FxPro Analyst Team