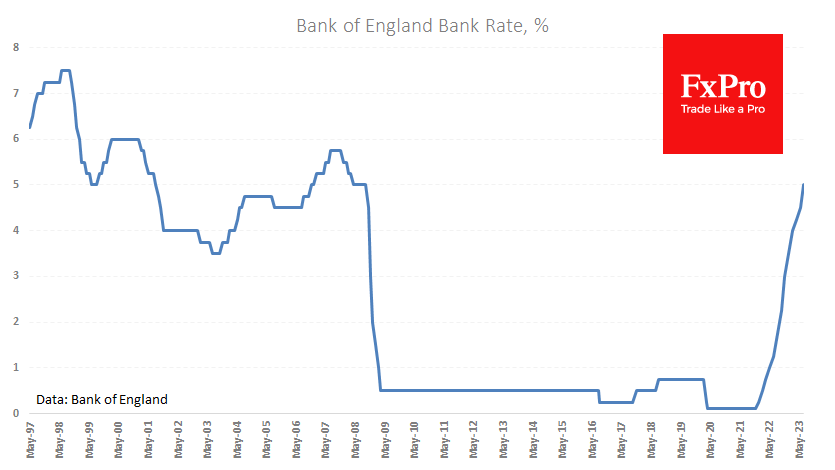

The Bank of England raised its key rate by 50bp to 5.00% – a sharper move than analysts who had made their forecasts earlier in the week had expected. However, it’s a logical move, given that the latest inflation data from the previous day exceeded both market expectations and the Bank’s forecasts. Given the persistently high inflation in the UK, we should have expected a tougher stance from the central bank.

In a companion commentary, the Bank of England acknowledged the secondary inflationary effects, from external shocks to rising service prices, solid consumer demand and a tight labour market. The forced cooling of the economy is a classic monetary policy response to the last two problems: developed country central banks are tightening policy to fight inflation until they get enough evidence of cooling final demand.

The market reaction to the rate surprise deserves a separate mention. GBPUSD jumped 60 pips up to 1.2840 and fell 100 pips down to 1.2740 within 10 minutes of the decision being published. This was obviously due to the trading robots working off the news headlines but ran into resistance from the sellers near the highs at last week’s close. However, the pound soon stabilised near the day’s opening levels, as markets saw the latest decision consistent with the available economic data.

The FxPro Analyst Team