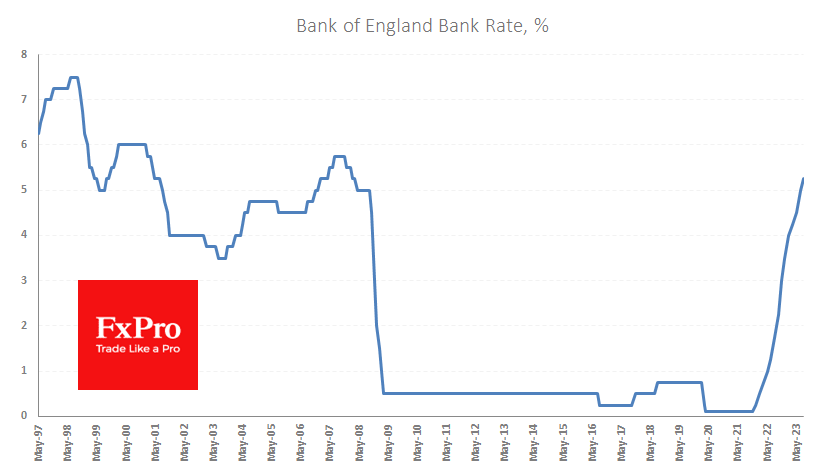

The Bank of England raised its key interest rate by 25 points to 5.25%, as widely expected by the market. Eight out of nine members voted for the hike, with two supporting a 50-basis point increase.

The Bank of England’s updated forecasts suggest that the rate will peak at over 6%, compared to “just over 4%” in the May Inflation Report. This is the market’s and the central bank’s response to sticky inflation.

Nevertheless, the labour market remains tight, and wage growth remains at 7.7% from three months to May. While wage increases are not to cover the acceleration in price growth over the past two years, they are not helping to bring inflation back to target. This means that the Bank of England must maintain its tight monetary policy stance, which it warned against at the end of its statement.

GBPUSD is down 0.4% today to 1.2650, with the BoE’s decision temporarily halting the slide amid a strengthening dollar. The pair broke out of its uptrend late last month and fell below its 50-day moving average this week. This now looks like the start of correcting the entire rally from last September’s lows. Potential targets are 1.25 (76.4% of the advance), 1.23 (200-day average) or 1.2070 (61.8%), with the second option being the most likely.

The FxPro Analyst Team