The Australian dollar hit its highest level since December 2023 against the US dollar, briefly topping 0.6800 following the release of the monthly inflation report.

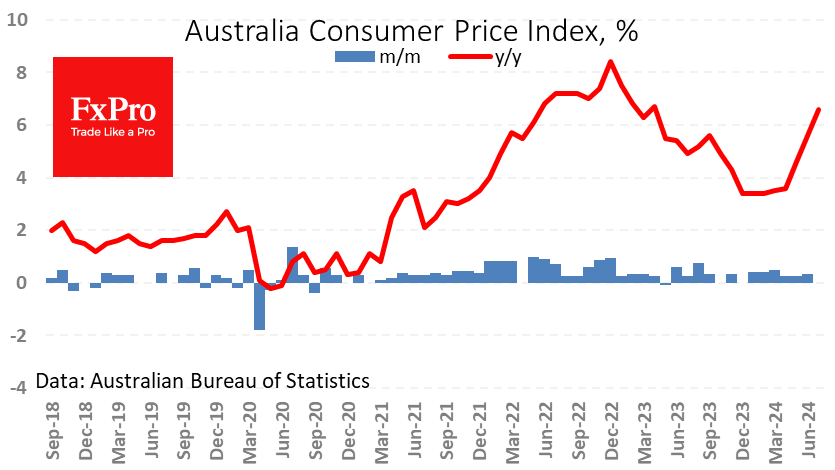

The Australian Bureau of Statistics reported that consumer price growth slowed to 3.5% y/y in July from 3.8% the previous month. Despite the slowdown, this indicator was higher than the expected 3.4%, further reducing the chances of a quick monetary policy reversal. Key drivers were housing costs (4%), food and non-alcoholic beverages (3.8%) and tobacco and alcohol (+7.2%).

Australia also took measures to combat rising house prices by restricting the number of international students. In addition, electricity bill rebates were resumed in July (-5.1% y/y vs. +7.1% y/y in June). With these measures in place, inflation looks resilient.

This is good news for the Australian currency, which has rebounded impressively since the sell-off in early August. The RBA’s hawkish tone, higher inflation, and a rebound in global risk appetite have contributed to the recovery.

The AUDUSD is testing the upper boundary of its 18-month trading range near 0.6800. In early August, the 0.6350 area reaffirmed its role as the turning point from decline to growth, as it has done over the last two years. The focus now is on whether the Aussie can break out of its long consolidation by breaking through a key resistance level.

This move could be an important indicator of a recovery in risk appetite and a resumption of the carry trade to which the Australian currency is sensitive. It could also signal a global shift in the dollar’s trading regime, sending it in search of a lower bottom.

The FxPro Analyst Team