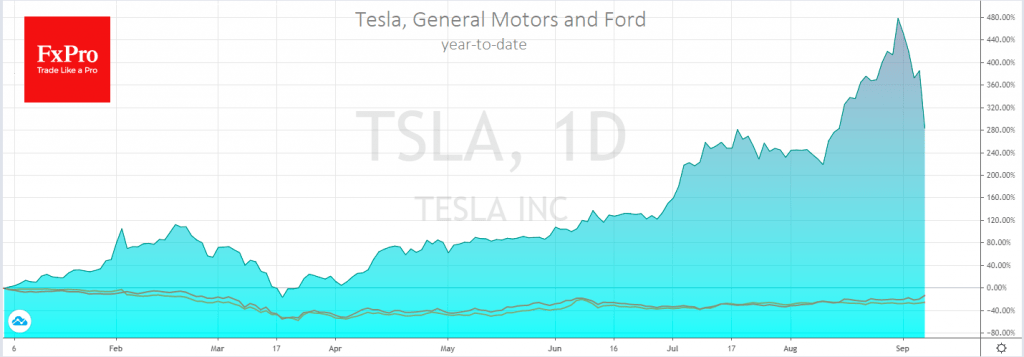

For the third trading session in a row, FAANG stocks and several other companies have been experiencing a hard landing after a flying sky-high in recent months. Tesla has been hit particularly hard. The price of its shares collapsed by more than 20%, the sharpest one-day drop in the ten-year trading history of this stock.

The price peaked on the 1st September when post-split quotes were above $500, but by the end of the day yesterday they were settled just under $330. However, it should be noted that the seemingly extreme sale at Tesla took the company’s capitalisation to levels of just a month ago, despite the more than 34% crash so far this month.

It is worth paying attention to the dynamics of competitors. For example, Ford share price, a favourite of American retail investors, added almost 2% against the background of a general decline in the markets. General Motors jumped by 8% on reports of the purchase of a share of another manufacturer of electric cars, Nikola. The value of the latter soared by 40% overnight.

The recent collapse of oil prices is in favour of traditional car companies. Fears of overstocking in the foreseeable future have returned to the market. This is good news for manufacturers of internal combustion engines, as it helps maintain demand for their more powerful and more expensive cars due to cheaper petrol.

On Wednesday morning, there is a slight rebound in the American indexes, which somewhat alleviates the degree of anxiety. The case of rising value stocks versus falling growth stocks allows us to regard current market movements as an extreme portfolio rebalancing rather than a complete risk-off in the markets for now.

The steady growth of the dollar since the beginning of the month does bring back to the agenda the idea that technology stocks are just the first steps on a broader market sale. This hypothesis is supported by severe movements in the GBPUSD pair, which plunged to 1.2930, losing 1.6% overnight.

EURUSD traded close to the August low at 1.1750. A drop below this may signal a broader correction in global markets, putting at risk not only a few of the heroes of the recent mega-rally but also a wider range of assets. Like the Euro, gold also nears its essential support from August, the $1900 level. A steady move below may be a warning sign of a broader elimination of risk positions and a move into a phase of poorly controlled decline.

The FxPro Analyst Team