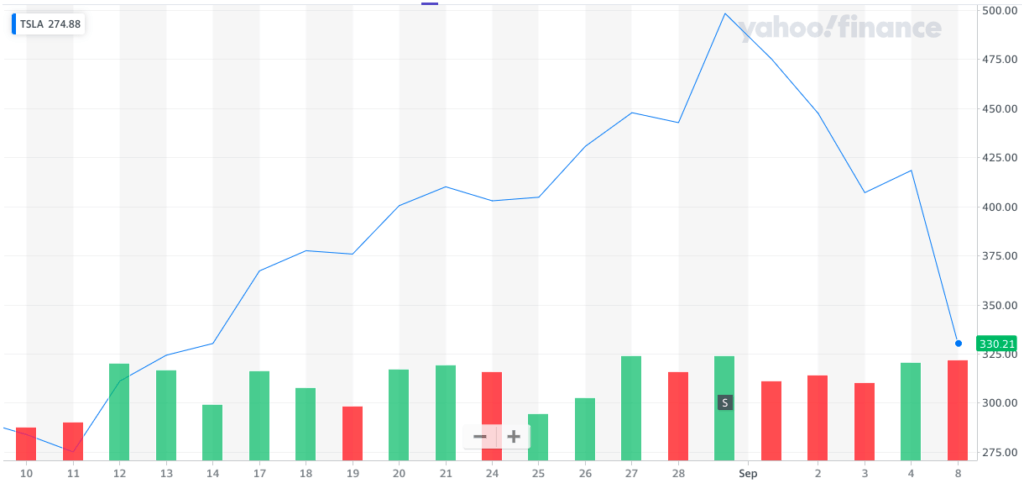

Tesla stock has climbed by 7% in early trading, after recording its biggest ever one-day loss on Tuesday. The company’s stock declined by 21.06% at close yesterday, as market fallout from its non-listing on the S&P 500 gained momentum.

Tesla bulls may be comforted by today’s pre-market rally, but it’s just as likely a dead cat bounce as a sign of a sustained recovery. The same issues that have dragged Tesla down since August 31 persist today, and with the wider stock market entering a bearish period, Tesla is likely to be pulled down further.

This was a disaster for a company that had enjoyed a 495% surge between January and the end of August. It was also a disaster for Elon Musk, whose net worth fell by $16.3 billion, the biggest one-day loss in the history of BBG Billionaires Index.

Believers in carmaker may be heartened by the fact that it’s currently 7% up in pre-market trading, at $353. This is most likely a dead cat bounce, with Tesla likely to fall further amid a general decline in the U.S. stock market.

The first indicator of this is that the 7% upswing falls far short of matching yesterday’s 21% downswing. This bears all the hallmarks of a dead cat bounce: short-term traders may be attempting to create and benefit from a brief rally, which will end as soon as they take their profits.

It’s also likely that the 7% jump is partly the result of traders closing out short positions. Recall that Tesla is one of the most shorted stocks in the market, so yesterday’s 21% plunge may have prompted many short sellers to close. This means they effectively buy Tesla stock, which can obviously pump prices.

After Worst-Day Ever, Tesla Stock Has A Dead Cat Bounce, CCN, Sep 9